2019-06-25 10:34:00 Tue ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

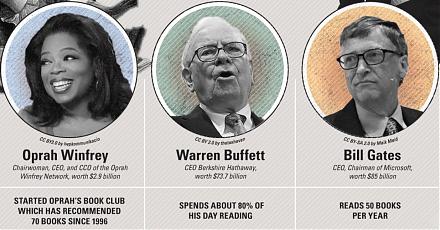

Investing in stocks is the best way for people to become self-made millionaires. A recent Gallup poll indicates that only 37% of young Americans below the age of 36 own stocks, whereas, about 61% of Americans over the age of 35 own stocks in the same period from 2017 to 2019. This evidence suggests that most Americans fail to leverage the U.S. stock market as a worthy investment vehicle. The magical power of compound interest exponentially contributes to wealth accumulation.

For instance, if a young investor saves $100 per week to earn an 11% stock market average return each year, he or she can receive about $1.2 million after 30 years. This financial discipline requires automatic money transfers on a periodic basis. In other words, most people can consistently invest a small amount of spare money with great discipline to reap exponential cash rewards at retirement age. Moreover, these wise investors can smooth out most extreme stock price gyrations by waiting patiently to accrue compound interest on regular stock investments. As compound interest snowballs into greater amounts of stock bets, both principal and interest payments roll over and become substantial lump sums after a sufficiently long time span.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2021-02-02 14:24:00 Tuesday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement

2019-06-17 11:25:00 Monday ET

To secure better economic arrangements with European Union, Jeremy Corbyn encourages Labour legislators to back a second referendum on Brexit. In recent tim

2018-05-11 09:37:00 Friday ET

OPEC countries have cut the global glut of oil production in recent years while the resultant oil price has surged from $30 to $78 per barrel from 2015 to 2

2019-11-23 08:33:00 Saturday ET

MIT financial economist Simon Johnson rethinks capitalism with better key market incentives. Johnson refers to the recent Business Roundtable CEO statement

2018-04-23 07:43:00 Monday ET

Harvard professor and former IMF chief economist Kenneth Rogoff advocates that artificial intelligence helps augment human productivity growth in the next d

2018-11-15 12:35:00 Thursday ET

Warren Buffett approves Berkshire Hathaway to implement new meaningful stock repurchases. Buffett sends a positive signal to the stock market with the Berks