2019-04-03 11:35:00 Wed ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

A Florida fintech group Fidelity Information Services initiates the largest $43 billion acquisition of the e-commerce payments processor Worldpay. Fidelity Information Services (FIS) provides computational systems for processing payments to a rich network of 14,000 banks. Upon deal closure, FIS shareholders own approximately 53% of the joint company, whereas, Worldpay shareholders retain 47% minority equity stakes. FIS executive management plans to pay the enterprise value of $43 billion with both stock and cash finance. FIS also expects to refinance residual debt after this strategic milestone.

As of April 2019, this acquisition is the largest deal in the fintech payments industry. The mega merger helps accelerate the current race to the top of global payments powerhouses. FIS and Worldpay can hence collaborate to offer a customer-centric combination of global scale with the bellwether broad range of both international fintech solutions and network effects for e-commerce payments.

Conservative estimates suggest an organic revenue growth rate of 6%-9% in the next 3 years. Net profit synergies amount to about $700 million over the same time horizon. Further, the global payments market is likely to double in size to $2 trillion from 2017 to 2027. These favorable forecasts suggest a bright outlook for FIS and Worldpay.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-12-21 11:39:00 Friday ET

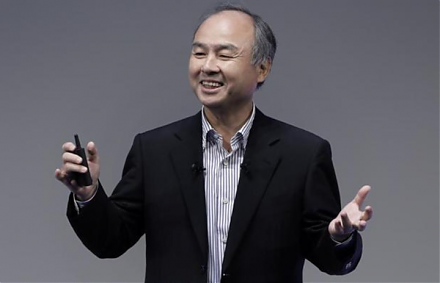

The Internet and telecom conglomerate SoftBank Group raises $23 billion in the biggest IPO in Japan. Going public is part of the major corporate move away f

2025-10-02 12:31:00 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-11-03 12:30:00 Sunday ET

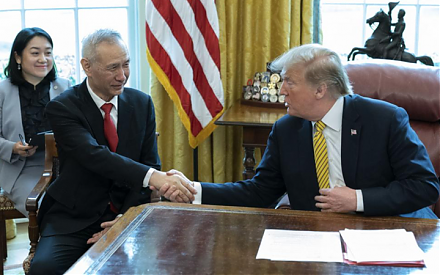

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice

2023-11-14 08:24:00 Tuesday ET

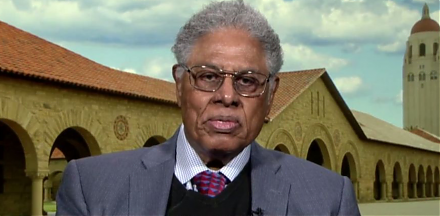

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo

2019-03-25 17:30:00 Monday ET

America seeks to advance the global energy dominance agenda by toppling Saudi Arabia as the top oil exporter by 2024. The International Energy Agency (IEA)

2018-03-17 09:35:00 Saturday ET

Facebook faces a major data breach by Cambridge Analytica that has harvested private information from more than 50 million Facebook users. In a Facebook pos