2019-04-03 11:35:00 Wed ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

A Florida fintech group Fidelity Information Services initiates the largest $43 billion acquisition of the e-commerce payments processor Worldpay. Fidelity Information Services (FIS) provides computational systems for processing payments to a rich network of 14,000 banks. Upon deal closure, FIS shareholders own approximately 53% of the joint company, whereas, Worldpay shareholders retain 47% minority equity stakes. FIS executive management plans to pay the enterprise value of $43 billion with both stock and cash finance. FIS also expects to refinance residual debt after this strategic milestone.

As of April 2019, this acquisition is the largest deal in the fintech payments industry. The mega merger helps accelerate the current race to the top of global payments powerhouses. FIS and Worldpay can hence collaborate to offer a customer-centric combination of global scale with the bellwether broad range of both international fintech solutions and network effects for e-commerce payments.

Conservative estimates suggest an organic revenue growth rate of 6%-9% in the next 3 years. Net profit synergies amount to about $700 million over the same time horizon. Further, the global payments market is likely to double in size to $2 trillion from 2017 to 2027. These favorable forecasts suggest a bright outlook for FIS and Worldpay.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-11-15 13:34:00 Friday ET

The Economist offers a special report that the new normal state of economic affairs shines fresh light on the division of labor between central banks and go

2017-12-01 06:30:00 Friday ET

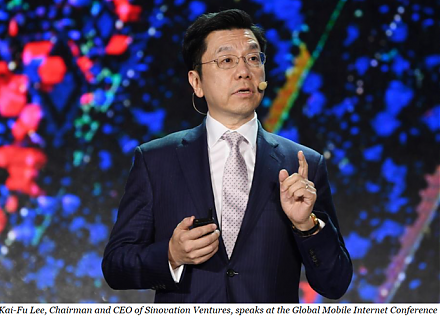

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M

2023-02-28 11:30:00 Tuesday ET

The Biden Inflation Reduction Act is central to modern world capitalism. As of 2022-2023, global inflation has gradually declined from the peak of 9.8% d

2018-11-17 09:33:00 Saturday ET

Zillow share price plunges 20% year-to-date as its competitors Redfin and Trulia also experience an economic slowdown in the real estate market. The real es

2017-06-27 05:40:00 Tuesday ET

These famous quotes of self-made billionaires are inspirational words of wisdom on financial management, innovation, and entrepreneurship. For financial

2019-06-11 12:33:00 Tuesday ET

Dallas Federal Reserve Bank President Robert Kaplan expects the U.S. economy to grow at 2.2%-2.5% in 2019-2020 as inflation rises a bit. In an interview wit