2017-04-01 06:40:00 Sat ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

With the current interest rate hike, large banks and insurance companies are likely to benefit from higher equity risk premiums and interest rate spreads.

Pre-crisis U.S. banks such as Goldman and Citigroup carry financial leverage as high as 35-to-1.

Meanwhile, these banks carry financial leverage about 10-to-1.

In this golden age of finance, it is likely for banks and insurance companies to lever up with robust operating profitability to 15-to-1 in light of post-Dodd-Frank deregulation under the Trump administration.

In this respect, financial stocks are likely to experience an imminent boom in stock market valuation.

The current Trump stock market rally bring tangible benefits to bank stocks that will likely receive preferential tax treatment in the form of both lower corporate income taxes and indefinite tax holidays for offshore cash repatriation.

As the current interest rate hike attracts capital inflows from non-U.S. economic regimes, this hot money will spur macroeconomic growth, corporate investment, and technological innovation with higher wages, better high-skill jobs, and more sustainable cash dividends, share repurchases, and capital gains for the typical stock market investor.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-12-22 14:38:00 Saturday ET

Federal Reserve raises the interest rate to the target range of 2.25% to 2.5% as of December 2018. Fed Chair Jerome Powell highlights the dovish interest ra

2019-09-17 08:33:00 Tuesday ET

Global stock market investors foresee the harbinger of a major economic downturn. Many stock market investors become anxious due to negative term spreads an

2019-03-29 12:28:00 Friday ET

Federal Reserve Chair Jerome Powell answers CBS News 60 Minutes questions about the recent U.S. economic outlook and interest rate cycle. Powell views the c

2018-01-02 12:39:00 Tuesday ET

Goldman Sachs takes a $5 billion net income hit that results from its offshore cash repatriation under the new Trump tax law. This income hit reflects 10%-1

2019-07-31 11:34:00 Wednesday ET

AYA Analytica finbuzz podcast channel on YouTube July 2019 In this podcast, we discuss several topical issues as of July 2019: (1) All 18 systemical

2017-06-21 05:36:00 Wednesday ET

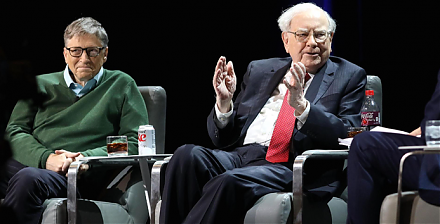

In his latest Berkshire Hathaway annual letter to shareholders, Warren Buffett points out that many people misunderstand his stock investment method in seve