2018-06-11 07:44:00 Mon ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Facebook, Apple, Amazon, Netflix, and Google (FAANG) have been the motor of the S&P 500 stock market index. Several economic media commentators contend that most U.S. stock market returns emerge from a small fraction of stocks. This concentration tilts toward network platform orchestrators that specialize in mobile communication, ecommerce, music, video, online search, and advertisement etc. These platform orchestrators attract many early technology adopters and venture capitalists. The former pour money into the mass purchases of mobile devices and online software services, and the latter inject capital into the tech titans at an early stage.

Apple and Amazon are both the first U.S. heavyweight tech giants that pass the landmark $1 trillion stock market valuation. Sino-American trade war worries now constrain S&P 500 year-to-date gains to 3.5% as of June 2018. In comparison, the FAANG group reaps hefty double-digits and so show business immunization to the Trump tariffs. The tech titans make productive uses of their intellectual properties such as patents, trademarks, and copyrights. This mega moat protection secures competitive advantages for their platform infrastructure.

As a result, these tech firms can better extract bottom-line rewards from the latest technological gadgets and services in mobile communication, ecommerce, online search, music, video, and advertisement etc.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-12-05 09:25:00 Tuesday ET

Better corporate ownership governance through worldwide convergence toward Berle-Means stock ownership dispersion Abstract We design a model

2018-11-17 09:33:00 Saturday ET

Zillow share price plunges 20% year-to-date as its competitors Redfin and Trulia also experience an economic slowdown in the real estate market. The real es

2018-08-27 09:35:00 Monday ET

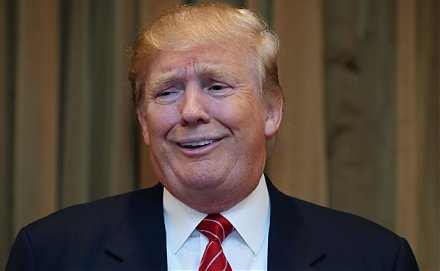

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2023-10-07 10:24:00 Saturday ET

Thomas Philippon draws attention to greater antitrust scrutiny in light of the rise of market power and its economic ripple effects. Thomas Philippon (20

2025-06-21 10:25:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why emotional intelligence can serve as a more important critical succ

2019-11-13 11:34:00 Wednesday ET

The new Brexit deal can boost British pound appreciation and economic optimism. British prime minister Boris Johnson wins the parliamentary vote on his new