2018-06-11 07:44:00 Mon ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Facebook, Apple, Amazon, Netflix, and Google (FAANG) have been the motor of the S&P 500 stock market index. Several economic media commentators contend that most U.S. stock market returns emerge from a small fraction of stocks. This concentration tilts toward network platform orchestrators that specialize in mobile communication, ecommerce, music, video, online search, and advertisement etc. These platform orchestrators attract many early technology adopters and venture capitalists. The former pour money into the mass purchases of mobile devices and online software services, and the latter inject capital into the tech titans at an early stage.

Apple and Amazon are both the first U.S. heavyweight tech giants that pass the landmark $1 trillion stock market valuation. Sino-American trade war worries now constrain S&P 500 year-to-date gains to 3.5% as of June 2018. In comparison, the FAANG group reaps hefty double-digits and so show business immunization to the Trump tariffs. The tech titans make productive uses of their intellectual properties such as patents, trademarks, and copyrights. This mega moat protection secures competitive advantages for their platform infrastructure.

As a result, these tech firms can better extract bottom-line rewards from the latest technological gadgets and services in mobile communication, ecommerce, online search, music, video, and advertisement etc.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-10-30 10:41:00 Tuesday ET

Personal finance author Ramit Sethi suggests that it is important to invest in long-term gains instead of paying attention to daily dips and trends. It

2019-09-25 15:33:00 Wednesday ET

Product market competition and online e-commerce help constrain money supply growth with low inflation. Key e-commerce retailers such as Amazon, Alibaba, an

2023-12-08 08:28:00 Friday ET

Tax policy pluralism for addressing special interests Economists often praise as pluralism the interplay of special interest groups in public policy. In

2019-08-01 11:33:00 Thursday ET

Many young and mid-career Americans fall into the financial distress trap in rural communities. A recent analysis of 25,800 zip codes for 99% of the U.S. po

2018-10-01 07:33:00 Monday ET

President Trump announces the new trilateral trade agreement among America, Canada, and Mexico: the U.S.-Mexico-Canada Agreement (USMCA) replaces and revamp

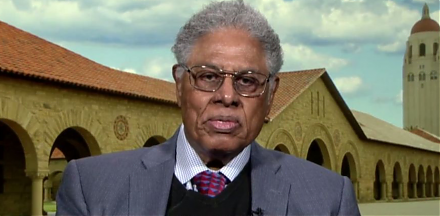

2023-11-14 08:24:00 Tuesday ET

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo