2018-03-09 08:33:00 Fri ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

David Solomon succeeds Lloyd Blankfein as the new CEO of Goldman Sachs. Unlike his predecessors Lloyd Blankfein and Gary Cohn, Solomon has been an investment specialist throughout his professional career. As an investment banker, Solomon serves as a major financial product specialist who underwrites and sells investment-grade corporate debt securities. Solomon understands well financial market development and the importance of marking-to-market the actual market values of stocks and bonds etc on the firm's balance sheet (instead of fair values). Also, Solomon appreciates the intrinsic value of efficient financial risk management.

Solomon can be a safe pair of hands to lead the Goldman franchise in late-2018. At Goldman Sachs, he advocates for a comprehensive reformation of corporate culture. He expresses an active interest in keeping the maximum number of work hours between 70-75 hours per week. Under his leadership, the bank increases compensation for programmers, modernizes computer systems, institutes video interviews, and maintains smart-casual dress codes.

Apart from his professional commitment, Solomon performs electronic music at nightclubs and music festivals in New York, Miami, and Bahamas. Spotify releases Solomon's debut single title in early-2018. As the CEO of Goldman Sachs, David Solomon will be an all-round investment head who understands the importance of work-life balance.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-08-19 10:34:00 Sunday ET

The World Economic Forum warns that artificial intelligence may destabilize the financial system. Artificial intelligence poses at least a trifecta of major

2019-05-01 09:27:00 Wednesday ET

Apple settles its 2-year intellectual property lawsuit with Qualcomm by agreeing to a multi-year patent license with royalty payments to the microchip maker

2019-06-11 12:33:00 Tuesday ET

Dallas Federal Reserve Bank President Robert Kaplan expects the U.S. economy to grow at 2.2%-2.5% in 2019-2020 as inflation rises a bit. In an interview wit

2017-10-03 18:39:00 Tuesday ET

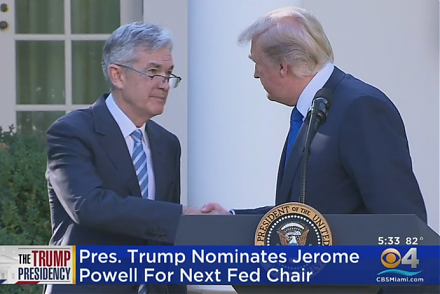

President Trump has nominated Jerome Powell to run the Federal Reserve once Fed Chair Janet Yellen's current term expires in February 2018. Trump's

2018-10-05 10:38:00 Friday ET

A 7-year $1.3 billion hedge fund manager Chelsea Brennan shares her investment advice. Her advice encompasses several steps toward better financial literacy

2018-12-19 17:41:00 Wednesday ET

Tencent Music Entertainment debuts its IPO on NYSE to strike a chord with stock market investors. Tencent Music goes public and marks the biggest IPO by a m