2018-07-11 09:39:00 Wed ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

In recent times, the Trump administration sees the sweet state of U.S. economic expansion as of early-July 2018. The latest CNBC All-America Economic Survey indicates 54% majority approval of the Trump team's supply-side economic reform. At least for 2018Q2, U.S. economic output grows at a hefty rate of 4% year-to-year. Non-farm payrolls add 213,000 full-time jobs in June 2018. Further, the U.S. trade deficit shrinks by 6.6% to $43 billion or the lowest level in 19 months.

U.S. average wages growth increases to 2.7%, whereas, CPI inflation remains as low as 2% that the Federal Reserve targets in order to maintain the current neutral interest rate hike. Unemployment is as low as 4% per annum, and most other top-line U.S. economic statistics land in reasonable ranges near full employment, the latter of which is part of the Federal Reserve's dual mandate. In light of this recent evidence, the Federal Reserve seems able to trade off maximum employment with moderate inflationary momentum.

President Trump deserves a lion's share of credit for this sweet state of economic affairs in America. The mid-term election stirs positive animal spirits and investor sentiments. The recent rollback of Dodd-Frank bank regulations boosts financial intermediary capital for better profitability, M&A momentum, and key balance sheet strength. Trump tax cuts breed corporate efficiency, capital investment growth, and both dividend payout and share buyback. These positive economic affairs trickle down to benefit shareholders, small-to-medium enterprises, and investment firms. Whether these economic affairs can sustain the current sweet state remains open to healthy debate due to bitter social polarization and rampant economic inequality.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-09-11 10:22:00 Friday ET

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools. In recent times, we have completed our fresh website up

2017-11-25 06:34:00 Saturday ET

Mario Draghi, President of the European Central Bank, heads the international committee of financial supervisors and has declared their landmark agreement o

2023-11-21 11:32:00 Tuesday ET

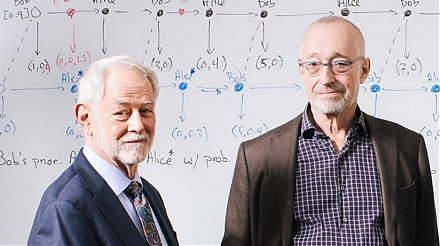

Nobel Laureate Paul Milgrom explains the U.S. incentive auction of wireless spectrum allocation from TV broadcasters to telecoms. Paul Milgrom (2019)

2017-04-01 06:40:00 Saturday ET

With the current interest rate hike, large banks and insurance companies are likely to benefit from higher equity risk premiums and interest rate spreads.

2025-09-24 09:49:53 Wednesday ET

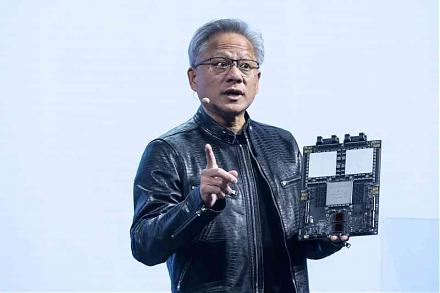

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-05-15 08:40:00 Tuesday ET

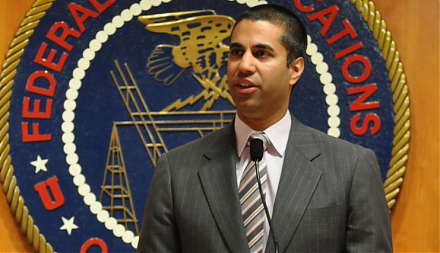

Net neutrality rules continue to revolve around the Trump administration's current IT agenda of 5G telecom transformation. Republican Senate passes the