2019-01-04 11:41:00 Fri ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Chinese President Xi JingPing calls President Trump to reach Sino-American trade conflict resolution. Xi sends a congratulatory message to mark 40 years since the progressive normalization of diplomatic relations between China and America. In fact, cooperation is the best choice for both sides in light of bilateral trade history. As Xi politely urges the Trump administration to compromise on the bilateral trade standoff, Xi seeks to avert the unilateral U.S. imposition of hefty tariffs on Chinese goods. The reconciliatory gesture serves as a mild response to the previous Trump trade battle plan of raising 10%-to-25% tariffs on $200+ million Chinese goods.

Trump tariffs are detrimental to the Chinese economy because the Shanghai-and-Shenzhen composite stock market indices plunge double-digits with subpar 6.5% real GDP growth in 2018. During the current 90-day trade truce, both teams hope to reach an eventual trade agreement that would benefit both countries as early as possible. Both presidents express sincere goodwill to implement Sino-U.S. trade concessions made on the G20 summit sidelines in 2018Q4.

As U.S. trade rep Robert Lighthizer characterizes the risks of allowing China to join the World Trade Organization, trade alone cannot douse the flames of international rivalry, whereas, economic prosperity often contributes to bilateral conflict.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-01-12 10:33:00 Saturday ET

With majority control, House Democrats pass 2 bills to reopen the U.S. government without funding the Trump border wall. President Trump makes a surprise Wh

2025-02-02 11:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2025. Our proprietary alpha investment model outperforms the ma

2021-08-01 07:26:00 Sunday ET

The Biden administration launches economic reforms in fiscal and monetary stimulus, global trade, finance, and technology. President Joe Biden proposes s

2018-04-05 07:42:00 Thursday ET

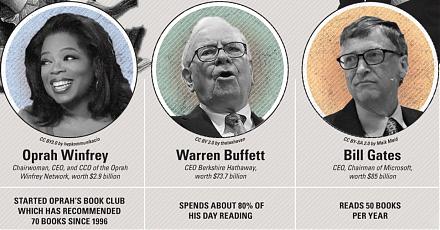

CNBC news anchor Becky Quick interviews Berkshire Hathaway's Warren Buffett in light of the recent stock market gyrations and movements. Warren Buffett

2020-03-19 13:39:00 Thursday ET

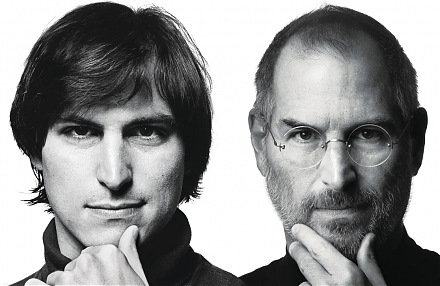

The business legacy and sensitivity of Steve Jobs can transform smart mobile devices with Internet connectivity, music and video content curation, and digit

2025-10-05 17:31:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund