2019-11-03 12:30:00 Sun ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice Premier Liu He indicates an active key interest from China in buying $40 billion to $50 billion American agricultural products such as soybeans and pork bellies. China expects the Trump team to institute another tariff reprieve in light of the interim partial trade agreement. Thus, there would be no 5% tariff hike on top of the current 25% tariffs on $250 billion Chinese goods. China further expects the Trump administration to circumvent blacklisting some Chinese tech titans such as HuaWei and Tencent. In response, however, U.S. trade rep Robert Lighthizer emphasizes that the HuaWei case should be kept separate from the interim partial trade deal.

Chinese trade delegation indicates a key interest in keeping the renminbi currency steady within reasonable ranges of exchange rates. Any new competitive currency manipulation or misalignment would not serve in the best interests of America and China. Moreover, China plans to further open up its asset markets by lifting foreign capital investment restrictions from April 2020 onwards.

On balance, peace and engagement can help attain the best compromise in Sino-American trade negotiations.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-06-21 05:36:00 Wednesday ET

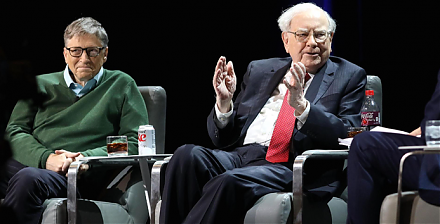

In his latest Berkshire Hathaway annual letter to shareholders, Warren Buffett points out that many people misunderstand his stock investment method in seve

2020-05-21 11:30:00 Thursday ET

Most blue-ocean strategists shift fundamental focus from current competitors to alternative non-customers with new market space. W. Chan Kim and Renee Ma

2018-07-17 08:35:00 Tuesday ET

Henry Paulson and Timothy Geithner (former Treasury heads) and Ben Bernanke (former Fed chairman) warn that people seem to have forgotten the lessons of the

2017-11-24 08:41:00 Friday ET

Is Bitcoin a legitimate (crypto)currency or a new bubble waiting to implode? As its prices skyrocket, bankers, pundits, and investors increasingly take side

2018-06-07 10:36:00 Thursday ET

AT&T wins court approval to take over Time Warner with a trademark $85 billion bid despite the Trump administration prior dissent due to antitrust conce

2025-03-03 04:11:06 Monday ET

Is higher stock market concentration good or bad for Corporate America? In recent years, S&P 500 stock market returns exhibit spectacular concentrati