2018-07-01 08:34:00 Sun ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Are China and Russia etc gonna dethrone the petrodollar? Over the years, China, Russia, France, Germany, and Japan have made numerous attempts to use their own reserve currencies as the primary monetary basis for futures in oil, silver, steel, aluminum, and other metals. De-dollarization helps non-U.S. companies anchor their use and consumption of natural resources to more reliable reserve currencies due to zero exposure to foreign exchange risk. Durable de-dollarization depends on a credible disinflationary monetary policy conduct and specific microeconomic measures. Not only does this strategy contribute to better financial risk mitigation, this strategy helps minimize any abrupt impact of greenback gyrations on domestic demand for oil, steel, and other natural resources. Often times de-dollarization can be conducive to promoting better open exchange rate flexibility, macroeconomic stabilization, inflation moderation, and financial crisis containment.

Should these countries and regions mute their exposure to dollar fluctuations over time, the greenback may become less than the gold standard of universal currency. Chinese, Russian, and Japanese companies can better acquire pivotal resources with minimal currency risk, whereas, de-dollarization remains an open challenge for France, Germany, and other European countries in the post-Brexit era.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-04-24 11:33:00 Friday ET

Disruptive innovations tend to contribute to business success in new blue-ocean markets after iterative continuous improvements. Clayton Christensen and

2019-02-21 12:37:00 Thursday ET

Apple shakes up senior leadership to initiate a new transition from iPhone revenue reliance to media and software services. These changes include the key pr

2018-04-20 10:38:00 Friday ET

Allianz chairman Mohamed El-Erian bolsters a new American economic paradigm in lieu of the Washington consensus. The latter dominates the old school of thou

2023-05-14 12:31:00 Sunday ET

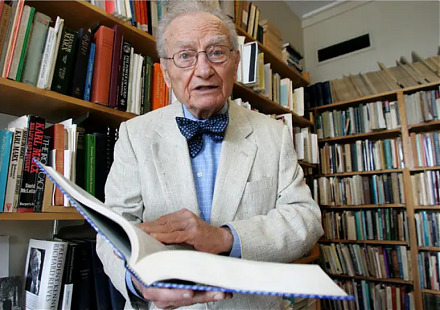

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m

2019-01-11 10:33:00 Friday ET

The Economist Intelligence Unit (EIU) continues to track major business risks in light of volatile stock markets, elections, and geopolitics. EIU monitors g

2020-11-17 08:27:00 Tuesday ET

Management consultants can build sustainable trust-driven client relations through the accelerant curve of business value creation. Alan Weiss (2016)