2019-06-27 10:39:00 Thu ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

Berkeley tax economists Gabriel Zucman and Emmanuel Saez find fresh insights into wealth inequality in America. Their latest estimates show that the top 0.1% of U.S. taxpayers control 20% of American wealth. This result represents the highest share since 1929. The top 1% of U.S. taxpayers control 39% of American wealth, whereas, the bottom 90% of U.S. taxpayers keep only 26% of American wealth. In contrast, the bottom half of Americans collectively have a negative net worth (i.e. total liabilities exceed total assets).

Zucman further finds that multinational corporations move 40% of their $600 billion offshore profits out of high-tax countries into lower-tax jurisdictions. With their main empirical results, Saez and Zucman both champion bold and aggressive tax policy recommendations. For instance, Senator Elizabeth Warren proposes a wealth tax that would rake in $2.8 trillion over the next decade. Warren confers with Saez and Zucman again before she floats a corporate tax on net profits above $100 million. This tax may raise $1 trillion over 10 years. Further, New York congressional rep Alexandria Ocasio-Cortez proposes to hike the top marginal tax rate for Americans who earn annual income above $10 million. The Saez-Zucman empirical results lend credence to these bold tax policy proposals.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2024-10-14 11:33:00 Monday ET

Stock Synopsis: Video games continue to take both screen time and monetization from many other forms of entertainment. We are broadly positive about the

2017-04-25 06:35:00 Tuesday ET

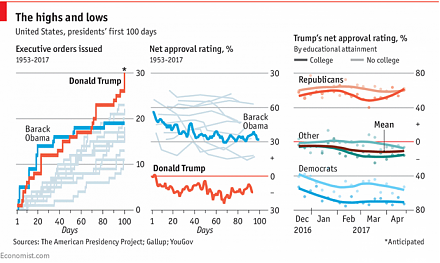

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.

2019-01-13 12:37:00 Sunday ET

We need crowdfunds to support our next responsive web design and iOS and Android app development. Upon successful campaign completion, we will provide an eb

2025-10-31 12:26:00 Friday ET

With respect to wider weight loss treatment and obesity treatment, the global market for GLP-1 medications now grows substantially to benefit more than 1 bi

2025-08-09 11:31:00 Saturday ET

Wharton e-commerce entrepreneurship professor Dr Karl Ulrich explains that many top-notch universities now provide massive open online courses (MOOCs) for m

2019-08-08 09:35:00 Thursday ET

Kobe Bryant and several other star athletes have been smart savvy investors. In collaboration with former Web.com CEO Jeff Stibel, the NBA champion invests