2017-05-01 09:45:00 Mon ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Apple now pursues an early harvest strategy that focuses on extracting healthy profits from a relatively static market for the Mac, iPhone, and iPad, all of which account for 85%+ of Apple's global revenue. Fortune futurists predict that Apple may adopt an aggressive acquisition strategy to consolidate many downstream media providers such as Netflix, Pandora, Disney, and Activision Blizzard.

During the Trump tax holiday, Apple seeks to repatriate as much as $250 billion offshore cash to invest in domestic job creation, manufacturing automation, and artificial intelligence.

As Apple CEO Tim Cook has indicated its ambitious fiscal plan to double media service revenue in the next 3 to 5 years, Apple needs to complete multiple M&A deals to achieve this high standard in stark contrast to organic growth.

Although many retail investors view this financial news as another speculative stock market rumor, time will tell whether Apple fulfills its medium-term trifecta of top dividend payout, offshore cash repatriation, and massive share buyback prior to 2020.

On balance, the world's largest tech giant offers a bright stock market prospect in terms of both robust operating performance and investment efficiency.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-04-11 07:35:00 Thursday ET

European Central Bank designs its current monetary policy reaction function and interest rate forward guidance in response to key delays in inflation conver

2018-11-11 13:42:00 Sunday ET

Michael Bloomberg provides $80 million as campaign finance for Democrats to flip the House of Representatives in the November 2018 midterm elections, gears

2022-04-15 10:32:00 Friday ET

Corporate investment management This review of corporate investment literature focuses on some recent empirical studies of M&A, capital investm

2019-02-28 12:39:00 Thursday ET

New York Fed CEO John Williams sees no need to raise the interest rate unless economic growth or inflation rises to a high gear. After raising the interest

2017-04-25 06:35:00 Tuesday ET

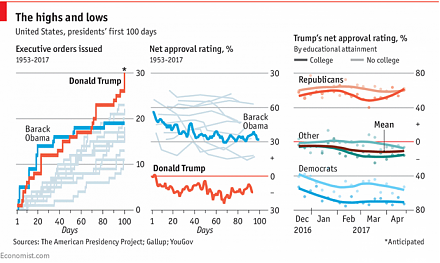

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.

2019-10-11 13:40:00 Friday ET

Apple CEO Tim Cook maintains a frugal low-key lifestyle. With $625 million public wealth, Cook leads the $1 trillion tech titan Apple in the post-Jobs era.