2019-02-09 08:33:00 Sat ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Apple provides positive forward guidance on both revenue and profit forecasts for iPhones, iPads, and MacBooks. In the Christmas 2018 festive season, MacBook revenue grows 9%; iPad sales climb 17%; and wearable devices from Apple Watch to AirPods surge by an impressive 50% growth margin. In 2019Q1, Apple reports the first holiday-quarter revenue decline since 2001 primarily because the pricey iconic iPhone X handsets experience a 15% decline in global sales. As Apple CEO Tim Cook delivers the non-iPhone revenue results to spark a 4% relief rally in the tech stock market, Apple regains the grand title of the most valuable company well beyond Microsoft, Amazon, and Google.

With respect to media services, Apple points to the substantial increase in Apple Pay and Apple Music worldwide usage. The next number of service subscriptions is likely to top half a billion by 2020 (up from 360 million in 2018Q4). Apple conducts several M&A deals such as the music recognition app Shazam and the digital news provider Texture with the key ambition of quadrupling revenue from media services by 2022. Without specifying techy details in Apple media services, Cook suggests that Apple expects to expand its original video content business in the foreseeable future.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-05-31 06:36:00 Wednesday ET

The Federal Reserve rubber-stamps the positive conclusion that all of the 34 major banks pass their annual CCAR macro stress tests for the first time since

2019-01-10 17:31:00 Thursday ET

The recent Bristol-Myers Squibb acquisition of American Celgene is the $90 billion biggest biotech deal in history. The resultant biopharma goliath would be

2018-12-11 10:34:06 Tuesday ET

Several eminent American China-specialists champion the key notion of *strategic engagement* with the Xi administration. From the Hoover Institution at Stan

2019-12-22 08:30:00 Sunday ET

European Commission President Ursula von der Leyen now protects the European circular economy and green growth from 2020 to 2050. The new circular economy r

2020-04-10 11:33:00 Friday ET

Elon Musk envisions a bold fantastic future with his professional trifecta of lean startup enterprises SolarCity, SpaceX, and Tesla. Ashlee Vance (2015)

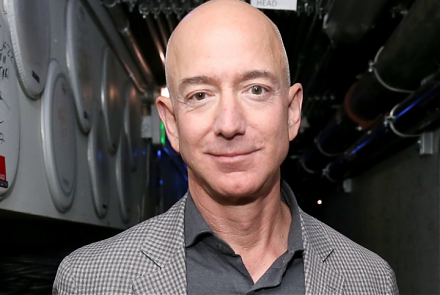

2019-04-17 11:34:00 Wednesday ET

Amazon CEO Jeff Bezos admits the fact that antitrust scrutiny remains a primary imminent threat to his e-commerce business empire. In his annual letter to A