2017-03-09 05:32:00 Thu ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

From 1927 to 2017, the U.S. stock market has delivered a hefty average return of about 11% per annum. The U.S. average stock market return is high in stark contrast to the average returns on bonds, currencies, mutual funds, exchange funds, warrants, and commodities such as gold, silver, oil, and wheat.

Behavioral economists such as Nobel Laureate Richard Thaler have coined this macrofinancial anomaly *the equity premium puzzle*.

This equity premium puzzle suggests that the U.S. double-digit performance is too high to reasonably reflect the typical investor's relative risk aversion in light of low consumption growth.

While many scholars strive to resolve this equity premium puzzle with complex math models, some recent evidence suggests that the American stock market experience proves to be the exception that defies the rule of thumb.

In other words, the American stock market stands out of the international crowd in terms of long-term average aggregate performance.

Positive U.S. investor sentiment highlights the long-term outperformance of the U.S. stock market relative to many other asset classes.

U.S. stocks remain the primary investment vehicle for most global institutional investors and North American retail investors.

Information technology usage, diffusion, and proliferation have spurred the U.S. spectacular stock market vibrancy over the past few decades.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-08-13 09:36:00 Sunday ET

Several investors and billionaires such as George Soros, Warren Buffett, Carl Icahn, and Howard Marks suggest that the time may be ripe for a major financia

2019-08-24 14:38:00 Saturday ET

Warren Buffett warns that the current cap ratio of U.S. stock market capitalization to real GDP seems to be much higher than the long-run average benchmark.

2023-06-19 10:31:00 Monday ET

A brief biography of Dr Andy Yeh (PhD, MFE, MMS, BMS, FRM, and USPTO patent accreditation) Dr Andy Yeh is responsible for ensuring maximum sustainable me

2018-11-01 08:36:00 Thursday ET

Ford and Baidu team up to test autonomous cars in China. For the next few years, Ford and Baidu plan to collaborate on the car design and user acceptance te

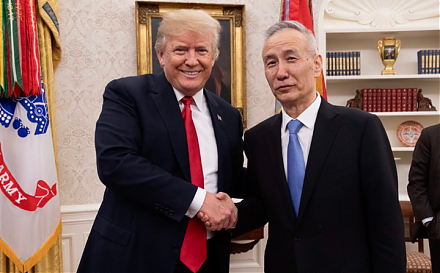

2018-10-17 12:33:00 Wednesday ET

The Trump administration blames China for egregious currency misalignment, but this criticism cannot confirm *currency manipulation* on the part of the Chin

2018-11-17 09:33:00 Saturday ET

Zillow share price plunges 20% year-to-date as its competitors Redfin and Trulia also experience an economic slowdown in the real estate market. The real es