2017-03-09 05:32:00 Thu ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

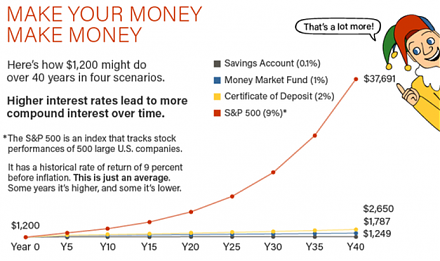

From 1927 to 2017, the U.S. stock market has delivered a hefty average return of about 11% per annum. The U.S. average stock market return is high in stark contrast to the average returns on bonds, currencies, mutual funds, exchange funds, warrants, and commodities such as gold, silver, oil, and wheat.

Behavioral economists such as Nobel Laureate Richard Thaler have coined this macrofinancial anomaly *the equity premium puzzle*.

This equity premium puzzle suggests that the U.S. double-digit performance is too high to reasonably reflect the typical investor's relative risk aversion in light of low consumption growth.

While many scholars strive to resolve this equity premium puzzle with complex math models, some recent evidence suggests that the American stock market experience proves to be the exception that defies the rule of thumb.

In other words, the American stock market stands out of the international crowd in terms of long-term average aggregate performance.

Positive U.S. investor sentiment highlights the long-term outperformance of the U.S. stock market relative to many other asset classes.

U.S. stocks remain the primary investment vehicle for most global institutional investors and North American retail investors.

Information technology usage, diffusion, and proliferation have spurred the U.S. spectacular stock market vibrancy over the past few decades.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-11-13 11:34:00 Wednesday ET

The new Brexit deal can boost British pound appreciation and economic optimism. British prime minister Boris Johnson wins the parliamentary vote on his new

2017-04-07 15:34:00 Friday ET

Would you rather receive $1,000 each day for one month or a magic penny that doubles each day over the same month? At first glance, this counterintuitive

2017-12-21 12:45:00 Thursday ET

Tony Robbins summarizes several personal finance and investment lessons for the typical layperson: We cannot beat the stock market very often, so it w

2019-04-09 11:29:00 Tuesday ET

The U.S. Treasury yield curve inverts for the first time since the Global Financial Crisis. The key term spread between the 10-year and 3-month U.S. Treasur

2018-10-13 10:44:00 Saturday ET

Dow Jones tumbles 3% or 831 points while NASDAQ tanks 4%, and this negative investor sentiment rips through most European and Asian stock markets in early-O

2019-01-19 12:38:00 Saturday ET

U.S. government shuts down again because House Democrats refuse to spend $5 billion on the border wall that would give President Trump great victory on his