2019-01-03 10:38:00 Thu ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

American parents often worry about money and upward mobility for their children. A recent New York Times survey suggests that nowadays American parents spend more time, effort, and money raising their kids. In recent times Merrill Lynch reports that the average cost of raising a child to 18 years old tops $230,000. The same report also suggests that 79% of American parents continue to provide financial support to their adult children. Costs for food, school, transportation, entertainment, technology, and other activities typically increase as children grow older. Also, 69% of parents admit to feeling pressure and even anxiety to give their children what their peers have.

There is an element of competition, peer pressure, or keeping up with the Joneses that entices parents to spend more money on their children. Economic prosperity motivates these parents to help ensure that their children are financially better off than the previous generations. A recent empirical study by the Federal Reserve Bank of St Louis demonstrates that millennials face unique financial struggles. The financial struggles include higher average unemployment rates, stagnant wages, less affordable residential properties, and student debt imbalances. Millennials are now at risk of becoming a unique lost generation that collectively accumulates less wealth during their lifetime.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-05-09 10:28:00 Thursday ET

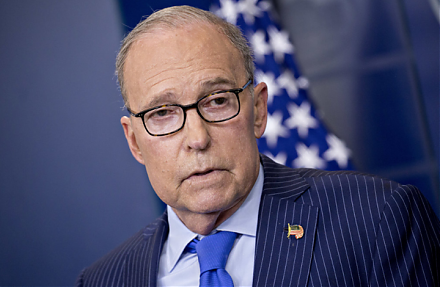

President Trump ramps up 25% tariffs on $200 billion Chinese imports soon after China backtracks on the Sino-American trade agreement. U.S. trade envoy Robe

2019-03-19 12:35:00 Tuesday ET

U.S. tech titans increasingly hire PhD economists to help solve business problems. These key tech titans include Facebook, Amazon, Microsoft, Google, Apple,

2017-01-11 11:38:00 Wednesday ET

Thomas Piketty's recent new book *Capital in the Twenty-First Century* frames income and wealth inequality now as a global economic phenomenon. When

2018-05-01 11:38:00 Tuesday ET

America and China play the game of chicken over trade and technology, whereas, most market observers and economic media commentators hope the Trump team to

2018-11-25 12:37:00 Sunday ET

The Chinese administration delivers a written response to U.S. demands for trade reforms. This strategic move helps trigger more formal negotiations between

2020-08-05 08:33:00 Wednesday ET

Business leaders often think from a systemic perspective, share bold visions, build great teams, and learn new business models. Peter Senge (2006) &nb