2018-01-23 06:38:00 Tue ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

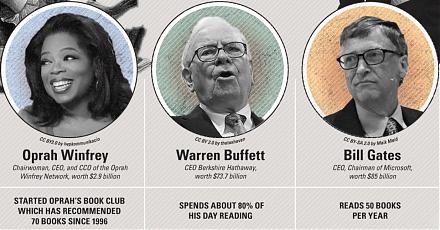

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, and hospitals. Jeff Bezos, Warren Buffett, and Jamie Dimon effectively take on the world's most expensive healthcare network. This non-profit venture poses a new challenge to an inefficient U.S. healthcare system. Also, this joint venture causes the share prices of healthcare companies to decline across the board.

The new company will initially focus on innovative technology for high-quality and transparent healthcare for 500,000+ U.S. employees across Amazon, Berkshire, and JPMorgan. The tripartite entity can negotiate directly with drugmakers, doctors, and hospitals in order to use their vast databases to handle high healthcare service costs. These negotiations thus undercut the healthcare industry's middlemen from health insurers to pharmacies such as CVS, Aetna, Cigna, and Merck.

U.S. healthcare expenditures increase faster than inflation from year to year. As of early-2018, these healthcare expenditures account for 18% of total real GDP. U.S. corporations sponsor healthcare benefits and services for more than 160 million American workers. Overall, the new tripartite venture represents a main healthcare innovation that can shake up the inefficient U.S. healthcare industry.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2026-02-02 12:30:00 Monday ET

With U.S. fintech patent approval, accreditation, and protection for 20 years, our proprietary alpha investment model outperforms most stock market indexes

2026-01-31 10:31:00 Saturday ET

In recent years, several central banks conduct, assess, and discuss the core lessons, rules, and challenges from their monetary policy framework r

2025-10-31 12:26:00 Friday ET

With respect to wider weight loss treatment and obesity treatment, the global market for GLP-1 medications now grows substantially to benefit more than 1 bi

2018-09-15 11:35:00 Saturday ET

Apple releases its September 2018 trifecta of smart phones or iPhone X sequels: iPhone Xs, iPhone Xs Max, and iPhone XR. Both iPhone Xs and iPhone Xs Max ha

2019-09-21 09:25:00 Saturday ET

President Trump praises great unity and progress at the G7 summit with respect to Sino-U.S. trade conflict resolution, global climate change, containment fo

2019-08-01 11:33:00 Thursday ET

Many young and mid-career Americans fall into the financial distress trap in rural communities. A recent analysis of 25,800 zip codes for 99% of the U.S. po