2022-03-05 09:27:00 Sat ET

stock market alpha value momentum behavioral finance size eugene fama ken french capm fama-french factor model mean-variance efficiency mutual fund management sharpe ratio william sharpe harry markowitz john cochrane profitability asset growth capital investment market risk default risk

Fama and French (2015) propose an empirical five-factor asset pricing model to capture the size, value, investment, and profitability patterns in stock returns as a better substitute for the three-factor model of Fama and French (1993). The primary problem for this five-factor model is its failure to capture the low average returns on small stocks whose returns behave like the average stock returns on firms that invest much despite their low profitability. With the major inclusion of both investment and profitability factors, the value factor of the Fama-French three-factor model becomes redundant for explaining average returns.

Although Gibbons, Ross, and Shanken’s (1989) F-test rejects the null hypothesis that the Fama-French five-factor model is correctly specified, the five-factor model produces substantially lower relative alphas and so outperforms the Fama-French (1993) three-factor model and the Carhart (1997) four-factor model. In an empirical sense, Fama and French’s (2015) five-factor model is similar to Hou, Xue, and Zhang’s (2014) q-factor model that cannot explain 20+ out of 80 asset pricing anomalies in the standard F-test of Gibbons, Ross, and Shanken (1989). Whether the Fama-French five-factor model with a redundant value factor collapses to the Hou-Xue-Zhang q-factor model in most static analysis remains an empirical puzzle. This multifactor asset pricing literature can contribute to the design of a workhorse model for corporate event assessment, equity cost estimation, risk management, and mutual fund performance evaluation.

Fama and French (2015) suggest that the Miller-Modigliani (1961) market-to-book equity equation helps explain why the Fama-French five-factor model better captures the variation in average stock returns. In particular, a more profitable firm yields more corporate income in the numerator and so requires a higher stock return in the denominator to keep the same market-to-book equity ratio (Fama and French, 2006; Novy-Marx, 2013). Furthermore, a firm that invests a lot faces faster asset growth in the numerator and so requires a lower stock return in the denominator to keep the same market-to-book equity ratio (Titman, Wei, and Xie, 2004; Fama and French, 2006, 2008; Cooper, Gulen, and Schill, 2008). Thus, much of the variation in average returns is left unexplained by the Fama-French (1993) three-factor model because this more parsimonious model overlooks the variation in stock returns due to firm-specific heterogeneity in both investment and profitability.

Vassalou and Xing (2004) provide the first empirical study of Merton’s (1974) option pricing model to compute default likelihood indicators for individual firms. This study assesses the effect of default risk on stock returns. Default risk is intimately related to the size and book-to-market characteristics of a firm. Specifically, the size effect exists only within the quintile with the highest default risk. In that subset, the return spread between small and large firms is about 45% per annum. Even within the high-default-risk quintile, small firms have higher default risk than large firms, and default risk decreases monotonically as size increases. A similar result applies to the book-to-market effect. The book-to-market effect exists only in the two quintiles with the highest default risk. Within the highest default risk quintile, the return spread between value and growth stocks is about 30% per annum. The returns spread between value and growth stocks decreases to 12.7% per annum for stocks in the second highest default risk quintile. Value stocks have much higher default risk than growth stocks, and there is a monotonic relation between book-to-market and default risk.

High-default-risk firms earn higher stock returns than low-default-risk firms only to the extent that these former firms are both small in size and high book-to-market. In addition to the above, Vassalou and Xing (2004) report asset pricing evidence to demonstrate that although the Fama-French risk factors SMB and HML contain information about firm-specific heterogeneity in default likelihood, these risk factors seem to convey important asset pricing information beyond the economic content of default risk metrics. Also, it is key to point out that Vassalou and Xing’s (2004) firm-specific default likelihood indicators take into account forward-looking information such as market equity value and asset volatility in the broad context of Merton’s (1974) option pricing model. This feature draws a distinction between Vassalou and Xing’s (2004) empirical default risk analysis and the previous literature on Altman’s (1968) Z-score model and Ohlson’s (1980) conditional logit O-score model, both of which seek to incorporate financial statement information into an empirical reduced-form analysis of financial distress risk (Dichev, 1998; Griffin and Lemmon, 2002).

Some earlier studies suggest that the Fama-French (1993) risk factors serve as relevant state variables in addition to the market risk premium in Merton’s (1973) intertemporal asset pricing model. For instance, Liew and Vassalou (2000) find that both SMB and HML help forecast future rates of economic growth when the econometrician relates these Fama-French factors to macroeconomic fluctuations throughout the business cycle. Also, both Lettau and Ludvigson (2001) and Vassalou (2003) find that accounting for macroeconomic risk reduces the predictive content of the Fama-French factors. An intertemporal asset pricing model implementation should relate the risk factors to innovations in state variables that forecast future investment opportunities (Campbell, 1996).

Petkova (2006) focuses on two major aspects of the investment opportunity set: the yield curve and the conditional distribution of stock returns. A vector autoregressive specification gauges innovations in state variables such as the aggregate dividend yield, the term spread, the default spread, and the risk-free rate. The Fama-French factors HML and SMB highly correlate with innovations in state variables that describe time variation in investment opportunities. HML proxies for a term spread surprise factor in stock returns while SMB proxies for a default spread surprise factor in stock returns (Hahn and Lee, 2006). A canonical model that includes as explanatory variables both the excess market return and several innovations in the aggregate dividend yield, the term spread, the default spread, and the risk-free rate has significantly better explanatory power than the Fama-French (1993) three-factor model in the cross-sectional spirit of Fama and MacBeth (1973) and Shanken (1992). The Fama-French factors HML and SMB are not significant explanatory variables for the cross-section of stock portfolio returns in the presence of both term-spread and default-spread innovations in state variables.

Campbell, Hilscher, and Szilagyi (2008) empirically refute the conventional view that the Fama-French factors SMB and HML serve as plausible proxies for financial distress risk. A dynamic panel logit model helps fit the empirical probabilities of business failure or bankruptcy for individual firms. This financial distress metric can be used to form stock portfolios. Campbell, Hilscher, and Szilagyi (2008) report that firms with higher distress risk have higher risk premia on the excess market return and the Fama-French (1993, 1996) factors SMB and HML in capturing the size and value effects. However, these firms have low average excess returns. In this light, the stock market has not properly priced this distress risk. The distress anomaly is stronger among small stocks, but this fact can be explained by the broader spread in financial distress among these stocks (i.e. per unit of log failure probability, the distress effect is constant across the size distribution). Ceteris paribus, the distress anomaly is stronger for stocks with low analyst coverage, institutional ownership, price per share, and liquidity. Like many other anomalies (Hong, Lim, and Stein, 2000; Nagel, 2005), the distress anomaly tends to concentrate in stocks that are likely to be expensive for institutional investors to arbitrage. This fact is a key challenge to a rational risk equilibrium explanation for the relation between financial distress and stock return performance.

Both Fama and French (2015) and Hou, Xue, and Zhang (2014) empirically find that HML becomes a redundant explanatory variable in the presence of state variables such as MRP, SMB, RMW, and CMA. While the conventional static time-series analysis does not account for the potentially dynamic nature of multifactor risk premia, the economic content of each state variable in general, and HML in particular, remains unknown. Future research can help demystify this puzzle in the empirical asset pricing literature.

A recent strand of asset pricing literature explores the conceptual relation between corporate investment and subsequent stock return performance in accordance with the q-theory (Berk, Green, and Naik, 1999; Gomes, Kogan, and Zhang, 2003; Carlson, Fisher, and Giammarino, 2004; Anderson and Garcia-Feijoo, 2006; Liu, Whited, and Zhang, 2009; Li, Livdan, and Zhang, 2009). When a publicly traded firm invests in M&A, capital stock, or R&D innovation, the importance of riskier growth options relative to less risky assets in place declines, reduces the firm’s risk exposure, and induces a negative nexus between corporate investment and subsequent stock return. Anderson and Garcia-Feijoo (2006) offer empirical support for this nexus. In essence, a firm’s investment decisions have a first-order impact on the firm’s risk profile, its market beta measurement, and so its stock return performance.

In contrast to this rational risk pricing q-theory, Titman, Wei, and Xie (2004) report alternative empirical evidence. Firms that increase their capital investments subsequently earn negative abnormal stock returns. This negative nexus is more pronounced for firms that have greater investment discretion (i.e. firms with greater cash flows and lower debt ratios). Moreover, this negative nexus is significant only in subsamples when hostile takeovers are less prevalent. These results accord with the behavioral mispricing hypothesis that many investors tend to underreact to the empire-building implications of corporate overinvestments. Although firms that increase capital investments tend to have higher past stock returns with positive net share issuance, the negative investment-return nexus is independent of the long-term stock return reversal and net share issuance anomalies (e.g. DeBondt and Thaler, 1985; Shleifer and Vishny, 1994; Fama and French, 2008; Pontiff and Woodgate, 2008).

Fama and French (2008) assess the size, value, momentum, investment asset growth, profitability, accrual, and share issuance anomalies. The anomalous stock returns are pervasive for share issuance, accrual, and momentum in all of the micro, small, and large size groups in Fama-MacBeth cross-sectional regressions. For instance, Daniel and Titman (2006) and Pontiff and Woodgate (2008) report a significantly negative association between net share issuance and subsequent stock return performance where net issuance can range from share repurchases to SEOs and stock mergers. In addition to the cross-sectional evidence, the anomalous returns are strong in the extreme portfolio tilts.

The investment asset growth and profitability anomalies are less robust (e.g. Titman, Wei, and Xie (2004); Cooper, Gulen, and Schill (2008); Fama and French (2006); Novy-Marx (2013)). There is an investment asset growth anomaly in average stock returns on microcaps and small stocks, but this anomaly is absent for large stocks. Among profitable firms, high profitability tends to correlate with abnormally high stock returns, but there is little evidence that unprofitable firms yield abnormally low stock returns. In fact, the primary problem with Fama and French’s (2015) five-factor asset pricing model is its failure to explain the low stock returns on small firms that invest a lot despite their low profitability. These firms exhibit high market betas, large share issues, and highly volatile stock returns. On the flip side of the economic story, profitable firms with conservative investment plans earn high average stock returns that reflect low market beta exposure, stock buyback, and stock return volatility.

Jagannathan and Wang (1996) point out that that there are at least two major empirical difficulties around the static analysis of the Sharpe-Lintner-Black CAPM. First, the static model does not properly account for the dynamic nature of multifactor risk premia in the fundamental context of the intertemporal CAPM (ICAPM) of Merton (1973), Campbell (1993), and Fama (1996). To the extent that ICAPM investors care about their terminal wealth and hedging investment opportunities, the latter serve as instruments for insurance against future adverse shocks. In the dynamic context, a conditional factor model permits each market beta exposure to move in tandem with macroeconomic fluctuations over time. Second, the mean-variance efficient market portfolio of aggregate wealth is not empirically observable (Roll, 1977). The presence of measurement noise contaminates the market beta estimates in the static CAPM. The available market portfolio proxies may not fully reflect the common sources of macroeconomic fluctuations such as the industrial-production growth rate, the inflation rate and its surprise shock, the ex post real interest rate, the change in average inflation, the term spread between the long-run government bond rate and the short-run Treasury bill rate, and the default spread between the investment-grade corporate bond rate and the long-term government bond rate (cf. Chen, Roll, and Ross (1986)).

Lewellen and Nagel (2006) fit the conditional market betas that change over time in short windows. The primary punchline is that the conditional CAPM does not adequately predict the cross-section of average stock returns. Subsequent conditional factor models that help capture the macroeconomic variation also fail to capture the ubiquitous asset pricing anomalies such as size, value, and momentum (e.g. Fama and French (2006); Ang and Chen (2007); Adrian and Franzoni (2009); Ang and Kristensen (2012)).

Yeh (2015) uses a simple and intuitive econometric method (cf. the recursive multivariate Kalman filter) to extract dynamic risk premia from the Fama-French (2015) five-factor asset pricing model. With all of the Fama-French five factors, this analysis is the first exploration of whether the pervasive asset pricing anomalies persist after the econometrician takes into account the time variation in multifactor risk premia. The ubiquitous anomalies of size, value, momentum, investment, profitability, short-term return reversal, and long-term return reversal vanish after one accounts for the dynamic nature of multifactor risk premia.

The key contribution of Yeh’s (2015) empirical study pertains to the design of a workhorse model in the asset pricing literature. The prior linear empirical asset pricing models arise as special cases of this more general dynamic multifactor model. This new workhorse model carries important implications for equity cost estimation, corporate event assessment, financial risk management, and mutual fund performance evaluation. The resultant dynamic analysis of multifactor risk premia proposes raising the hurdle for the conventional econometric asset pricing test. This recommendation serves as the time-series equivalent to the cross-sectional thesis of Harvey, Liu, and Zhu (2015).

Post-earnings-announcement drift (PEAD) refers to the usual tendency for a stock’s cumulative abnormal returns to drift in the direction of an earnings surprise for several weeks or several months after a major earnings announcement. Both standardized unexpected earnings (SUE) and cumulative abnormal returns (CAR) can be used to measure the magnitude of momentum profits over the 120-day time horizon around the earnings announcement date (Ball and Brown, 1968; Bernard and Thomas, 1989). A prominent story for this behavioral momentum pattern is that investors often underreact to major earnings announcements (Hong and Stein, 1999; Hong, Lim, and Stein, 2000; Hirshleifer and Subrahmanyam, 2001; Barberis and Shleifer, 2003; Hong, Torous, and Valkanov, 2007). While both CAPM misspecification bias and delayed information can be plausible reasons for this behavioral momentum pattern, Bernard and Thomas (1989) find strong serial correlation of quarterly net income in support of a slow response to market information.

Jegadeesh and Titman (1993) and Barberis, Shleifer, and Vishny (1998) document that investors have a conservatism bias or limited attention as one of the major representative heuristics: many investors tend to underweight new information in updating prior beliefs about corporate earnings growth. Momentum profits that arise from both buying recent past winners and selling recent past losers persist over the 6-month to 12-month time horizon. With analyst forecast revision data, Chan, Jegadeesh, and Lakonishok (1996) and Jegadeesh and Titman (2001) provide more recent evidence in support of the behavioral story that investors tend to underreact to new market information. This investor underreaction accentuates the persistence of momentum profits.

Rouwenhorst (1998) reports a similar momentum phenomenon in 12 European countries and thus rules out the issue of data snooping bias that may plague the empirical evidence of stock return continuation in America. Fama and French’s (1996) multifactor asset pricing model and its variant by Carhart (1997) suggest that the momentum effect is real because this effect cannot be readily explained by the canonical multifactor asset pricing model. An internationally diversified portfolio of past medium-term winners outperforms a similar portfolio of medium-term losers after the econometrician corrects for risk by more than 1% per month. Return continuation is present in all 12 European countries and lasts on average for about one year. Also, this return continuation is negatively related to firm size, but is not limited to small firms. The international momentum returns highly correlate with the momentum returns in America. In turn, this evidence suggests that international exposure to a common factor contributes to the profitability of momentum strategies.

In addition to the above explanations for price momentum, Conrad and Kaul (1998) empirically report that the cross-sectional variation in momentum profits continues to persist in any post-holding period. In fact, the momentum profits persist in the medium 3-month to 12-month horizons (while the contrarian strategy yields significantly positive excess returns over long time horizons). Further, Daniel, Hirshleifer, and Subrahmanyam (1998) point out that investors often attribute good stock performance to their own stock selection skills. This self-attribution reinforces investor overconfidence and boosts stock prices too high for recent past winners. Thus, the delayed investor response leads to short-term momentum profits that are eventually reversed with negative long-lag autocorrelation, excess volatility, and material time-series stock return predictability.

Hong and Stein (1999) derive a behavioral model for the equilibrium interplay between two groups of boundedly rational agents: news-watchers and trend-chasers. Each news-watcher observes some private information, but fails to extract other news-watchers’ information from prices. If information diffuses gradually across the population, prices underreact to new information in the short run. This underreaction suggests that trend-chasers profit from their price momentum strategies by buying past winners. However, if these trend-chasers only implement simple univariate strategies, their arbitrage attempts would result in overreaction at long horizons. In this light, Hong and Stein (1999) provide a uniform field theory of both stock return continuance and reversal at different time horizons.

There are several empirical tests for the price momentum phenomenon. First, standardized unexpected earnings (SUE) and cumulative abnormal returns (CAR) can be used to measure the magnitude of short-term momentum profits over the 120 trading days around the earnings announcement date (Bernard and Thomas, 1989). Second, Fama and MacBeth (1973) propose a two-stage procedure for cross-sectional regressions. The first step entails running month-by-month cross-sectional regressions of stock returns on 6-month to 12-month buy-and-hold returns, betas, market cap values, book-to-market ratios, and sales growth rates. The second step requires taking the time-series intercept and slope estimates to test whether the average premium is positive with the Newey-West consistent estimation of the covariance-variance matrix (e.g. Fama and French (1992, 2008); Cooper, Gulen, and Schill (2008)). Third, Fama and French (1996) run the multifactor time-series regression of excess returns on MRP, SMB, HML, and potentially WML (Carhart, 1997). Then the econometrician can run Gibbons, Ross, and Shanken’s (1989) F-test to examine whether the monthly alphas are jointly far from zero. The return spread for the extreme deciles can further be tested against the null hypothesis that the multifactor model is correctly specified.

It is straight-forward to summarize the main evidence in support of the price momentum phenomenon. The SUE and CAR tests readily confirm the existence of post-earnings-announcement-drift momentum profits. The Fama-MacBeth cross-sectional regression tests are less conclusive. While Fama and French (2008) find that momentum tends to be a persistent anomaly only for small and profitable stocks, Cooper, Gulen, and Schill (2008) report that the 6-month or 3-year momentum pattern vanishes after one controls for asset growth. Furthermore, Fama and French’s (1996) multifactor model cannot readily reconcile the momentum anomaly with a rational risk model in the context of Merton’s (1973) intertemporal CAPM. Jegadeesh and Titman (1993, 2001) and Chan, Jegadeesh, and Lakonishok (1996) document robust and persistent evidence in support of 6-month to 12-month short-run stock return momentum.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-03-07 11:29:00 Tuesday ET

Former Bank of England Governor Mervyn King provides his deep substantive analysis of the Global Financial Crisis of 2008-2009. Mervyn King (2017) &nb

2023-04-21 12:39:00 Friday ET

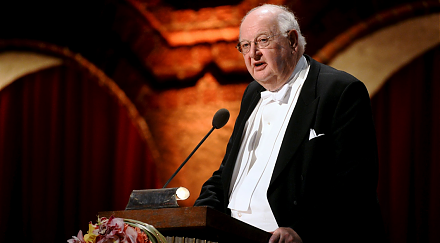

Angus Deaton analyzes the correlation between health and wealth in light of the economic origins of inequality worldwide. Angus Deaton (2015)

2023-09-28 08:26:00 Thursday ET

Daron Acemoglu and James Robinson show a constant economic tussle between society and the state in the hot pursuit of liberty. Daron Acemoglu and James R

2017-03-21 09:37:00 Tuesday ET

Trump and Xi meet in the most important summit on earth this year. Trump has promised to retaliate against China's currency misalignment, steel trade

2020-04-10 11:33:00 Friday ET

Elon Musk envisions a bold fantastic future with his professional trifecta of lean startup enterprises SolarCity, SpaceX, and Tesla. Ashlee Vance (2015)

2023-05-31 03:15:40 Wednesday ET

The U.S. further derisks and decouples from China. Why does the U.S. seek to further economically decouple from China? In recent times, th