2018-11-29 11:33:00 Thu ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

A congressional division between Democrats and Republicans can cause ripple effects on Trump economic reforms. As Democrats have successfully flipped the House of Representatives, Republicans retain a bigger majority in the Senate. Now Democrats represent a key majority of American voters, but Republicans dominate geographic constituents across the U.S. states. The Economist suggests that this division of congressional power can be a recipe for gridlock, poor governance, and eventually, disenchantment with the political system when one chamber of the U.S. legislature garners popular support and the other receives territorial support.

Several economic priorities arise as topical issues for Democrats. First, Democrats can exercise restraint on presidential abuses of power. For instance, Democrats can help ensure that federal agencies such as the Federal Reserve and Treasury should make independent policy decisions with minimal presidential influence and interference. Specifically, the Federal Reserve should continue the current interest rate hike for better inflation containment, monetary expansion, and credit supply growth when the U.S. economy operates near full employment. The U.S. Treasury should help better balance the fiscal budget with at least $2 trillion national debt and about $800 billion annual deficits when the real GDP per capita needs to grow at 3%-4% in order to fill the fiscal void left by U.S. budget and trade deficits.

Second, Democrats can cooperate with the Trump administration and Republican senators on infrastructure, immigration, and health care to appeal to a broad base of American voters. U.S. infrastructure and immigration should be less toxic when Democrats work well with Republicans to approve necessary budget deals for both vital job creation and organic population growth. Also, Democrats can find feasible solutions for the Trump administration to lower drug prices and other medical costs with little disruption to the pharmaceutical industry.

Third, Democrats should refrain from opposing every constructive proposal from the Trump administration. No rational party can abuse its House majority to block sensible and useful public policies. On the economic front, Democrats should see value in antitrust regulation of tech titans such as Amazon, Facebook, and Google etc across e-commerce, social media, and Internet search. Democrats should also recognize the importance of regular macroprudential stress tests for systemically-important banks to better monitor their long-term financial viability and resilience. On balance, Democrats can collaborate with the Trump team and Republicans for better economic governance as both parties seek and concoct bipartisan solutions, middle grounds, and common interests.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-04-19 12:35:00 Friday ET

Federal Reserve proposes to revamp post-crisis rules for U.S. banks. The current proposals would prescribe materially less strict requirements for community

2018-03-25 08:39:00 Sunday ET

President Trump imposes punitive tariffs on $60 billion Chinese imports in a brand-new trade war as China hits back with retaliatory tariffs on $3 billion U

2018-01-15 07:35:00 Monday ET

Treasury Secretary Steven Mnuchin welcomes a weak U.S. dollar amid pervasive fears of an open trade war between America and China. At the World Economic For

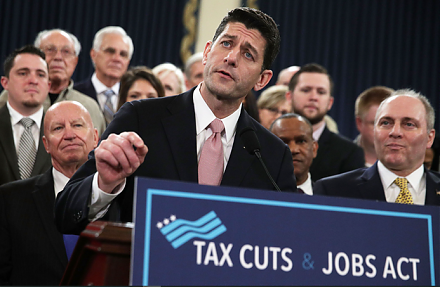

2017-11-17 09:42:00 Friday ET

The Trump administration garners congressional support from both Senate and the House of Representatives to pass the $1.5 trillion tax overhaul (Tax Cuts &a

2019-10-29 13:36:00 Tuesday ET

The OECD projects global growth to decline from 3.2% to 2.9% in the current fiscal year 2019-2020. This global economic growth projection represents the slo

2019-05-03 11:29:00 Friday ET

Key tech unicorns blitzscale business niches for better scale economies from Uber and Lyft to Pinterest, Slack, and Zoom. LinkedIn cofounder and serial entr