Search results : stock market

2023-12-09 08:28:00 Saturday ET

2023-12-05 09:25:00 Tuesday ET

2023-12-04 12:30:00 Monday ET

2023-12-03 11:33:00 Sunday ET

2023-11-30 08:29:00 Thursday ET

2023-11-07 11:31:00 Tuesday ET

2023-10-28 12:29:00 Saturday ET

2023-10-21 11:32:00 Saturday ET

2023-10-19 08:26:00 Thursday ET

2023-10-14 10:32:00 Saturday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-07-14 10:32:00 Friday ET

Ray Fair applies his macroeconometric model to study the central features of the U.S. macroeconomy such as price stability and full employment in the dual m

2019-11-23 08:33:00 Saturday ET

MIT financial economist Simon Johnson rethinks capitalism with better key market incentives. Johnson refers to the recent Business Roundtable CEO statement

2018-02-11 07:30:00 Sunday ET

President Trump unveils his ambitious $1.5 trillion public infrastructure plan. Trump proposes offering $100 billion in federal incentives to encourage stat

2019-04-19 12:35:00 Friday ET

Federal Reserve proposes to revamp post-crisis rules for U.S. banks. The current proposals would prescribe materially less strict requirements for community

2019-05-17 15:24:00 Friday ET

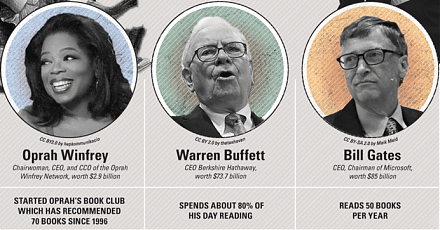

A Harvard MBA graduate Camilo Maldonado shares several life lessons and wise insights into personal finance. People can leverage stock market investments an

2019-10-31 13:38:00 Thursday ET

AYA Analytica finbuzz podcast channel on YouTube October 2019 In this podcast, we discuss several topical issues as of October 2019: (1)