Search results : sharpe ratio

2022-11-25 09:29:00 Friday ET

2022-03-05 09:27:00 Saturday ET

2022-02-25 00:00:00 Friday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-09-03 10:26:00 Thursday ET

Agile business firms beat the odds by building faster institutional reflexes to anticipate plausible economic scenarios. Christopher Worley, Thomas Willi

2019-01-19 12:38:00 Saturday ET

U.S. government shuts down again because House Democrats refuse to spend $5 billion on the border wall that would give President Trump great victory on his

2019-12-04 14:35:00 Wednesday ET

Many billionaires choose to live below their means with frugal habits and lifestyles. Those people who consistently commit to saving more, spending less, an

2018-11-19 09:38:00 Monday ET

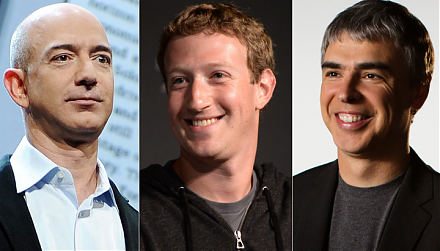

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl

2019-08-07 12:33:00 Wednesday ET

Conor McGregor learns a major money lesson from LeBron James. This lesson suggests that James spends about $1.5 million on his own body each year. The $1.5

2019-10-17 08:35:00 Thursday ET

The European Central Bank expects to further reduce negative interest rates with new quantitative government bond purchases. The ECB commits to further cutt