Search results : sharpe ratio

2022-11-25 09:29:00 Friday ET

2022-03-05 09:27:00 Saturday ET

2022-02-25 00:00:00 Friday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-05-21 07:39:00 Monday ET

Dodd-Frank rollback raises the asset threshold for systemically important financial institutions (SIFIs) from $50 billion to $250 billion. This legislative

2017-12-07 08:31:00 Thursday ET

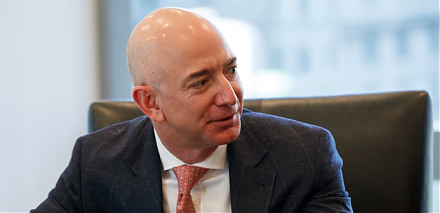

Large multinational tech firms such as Facebook, Apple, Microsoft, Google, and Amazon can benefit much from the G.O.P. tax reform. A recent stock research r

2025-10-03 10:31:00 Friday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2020-11-01 11:21:00 Sunday ET

Artificial intelligence continues to push boundaries for several tech titans to sustain their central disruptive innovations, competitive moats, and first-m

2017-12-09 08:37:00 Saturday ET

Michael Bloomberg, former NYC mayor and media entrepreneur, criticizes that the Trump administration's tax reform is a trillion dollar blunder because i

2018-01-07 09:33:00 Sunday ET

Zuckerberg announces his major changes in Facebook's newsfeed algorithm and user authentication. Facebook now has to change the newsfeed filter to prior