Search results : momentum

2022-11-25 09:29:00 Friday ET

2022-03-05 09:27:00 Saturday ET

2020-09-15 08:38:00 Tuesday ET

2020-02-05 10:28:00 Wednesday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-07-23 09:22:00 Tuesday ET

Harvard economic platform researcher Dipayan Ghosh proposes some alternative solutions to breaking up tech titans such as Facebook, Google, Apple, and Amazo

2017-12-09 08:37:00 Saturday ET

Michael Bloomberg, former NYC mayor and media entrepreneur, criticizes that the Trump administration's tax reform is a trillion dollar blunder because i

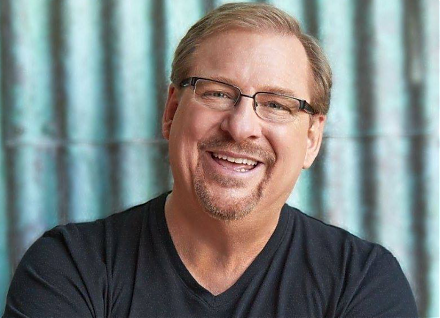

2020-08-26 10:33:00 Wednesday ET

Through purposeful leadership, senior managers inspire teams to reach heights of both innovation and profitability with great brand identity and customer lo

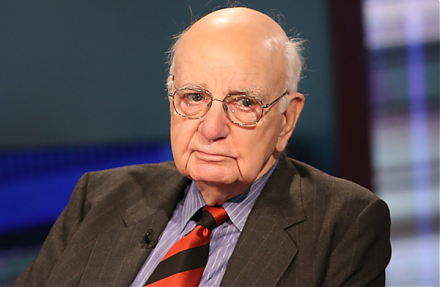

2018-10-23 12:36:00 Tuesday ET

Former Fed Chair Paul Volcker releases his memoir, talks about American public governance, and worries about plutocracy in America. Volcker suggests that pu

2019-06-19 09:27:00 Wednesday ET

San Francisco Fed CEO Mary Daly suggests that trade escalation is not the only risk in the global economy. Due to the current Sino-U.S. trade tension, the g

2018-08-17 11:45:00 Friday ET

In accordance with the extant corporate disclosure rules and requirements, all U.S. public corporations have to report their balance sheets, income statemen