Search results : managerial entrenchment

2023-12-05 09:25:00 Tuesday ET

2022-11-15 10:30:00 Tuesday ET

2022-11-05 11:32:00 Saturday ET

2022-10-25 11:31:00 Tuesday ET

2022-10-15 09:34:00 Saturday ET

2022-10-05 08:24:00 Wednesday ET

2022-04-25 10:34:00 Monday ET

2022-04-15 10:32:00 Friday ET

2022-04-05 17:39:00 Tuesday ET

2022-03-25 09:34:00 Friday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-11-30 08:29:00 Thursday ET

In addition to the OECD bank-credit-card model and Chinese online payment platforms, the open-payments gateways of UPI in India and Pix in Brazil have adapt

2026-02-02 12:30:00 Monday ET

With U.S. fintech patent approval, accreditation, and protection for 20 years, our proprietary alpha investment model outperforms most stock market indexes

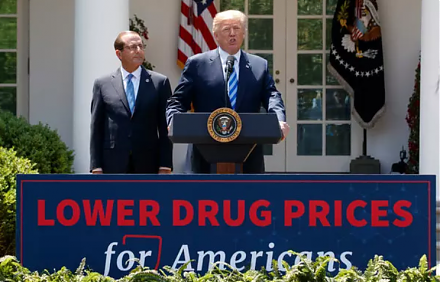

2018-05-07 07:32:00 Monday ET

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri

2018-03-11 08:27:00 Sunday ET

At 89 years old, Hong Kong billionaire Li Ka-Shing announces his retirement in March 2018. With a personal net worth of $35 billion, Li has an incredible ra

2017-08-25 13:36:00 Friday ET

The U.S. Treasury's June 2017 grand proposal for financial deregulation aims to remove several aspects of the Dodd-Frank Act 2010 such as annual macro s

2020-06-10 10:35:00 Wednesday ET

Most lean enterprises should facilitate the dual transformation of both core assets with fresh cash flows and new growth options. Scott Anthony, Clark Gi