Search results : liquidity risk

2022-10-15 09:34:00 Saturday ET

2022-10-05 08:24:00 Wednesday ET

2022-03-25 09:34:00 Friday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2022-02-22 09:30:00 Tuesday ET

The global asset management industry is central to modern capitalism. Mutual funds, pension funds, sovereign wealth funds, endowment trusts, and asset ma

2019-10-03 17:39:00 Thursday ET

President Trump indicates that he would consider an interim Sino-American trade deal in lieu of a full trade agreement. The Trump administration defers high

2023-07-21 10:30:00 Friday ET

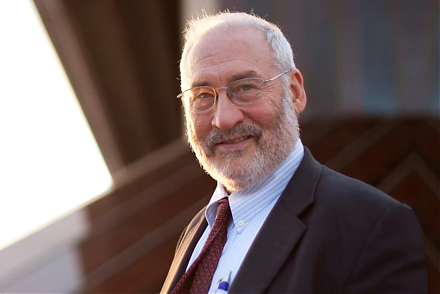

Joseph Stiglitz and Andrew Charlton suggest that free trade helps promote better economic development worldwide. Joseph Stiglitz and Andrew Charlton (200

2024-02-05 11:26:00 Monday ET

China poses new economic, technological, and military threats to the U.S. and many western allies. In the U.S. government assessment, China poses new eco

2018-05-13 08:33:00 Sunday ET

Incoming New York Fed President John Williams suggests that it is about time to end forward guidance in order to stop holding the financial market's han

2018-08-03 07:33:00 Friday ET

President Trump escalates the current Sino-American trade war by imposing 25% tariffs on $200 billion Chinese imports. These tariffs encompass chemical prod