Search results : corporate governance

2023-12-05 09:25:00 Tuesday ET

2022-11-15 10:30:00 Tuesday ET

2022-11-05 11:32:00 Saturday ET

2022-10-25 11:31:00 Tuesday ET

2022-04-25 10:34:00 Monday ET

2022-04-15 10:32:00 Friday ET

2022-04-05 17:39:00 Tuesday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-08-17 11:45:00 Friday ET

In accordance with the extant corporate disclosure rules and requirements, all U.S. public corporations have to report their balance sheets, income statemen

2026-02-02 12:30:00 Monday ET

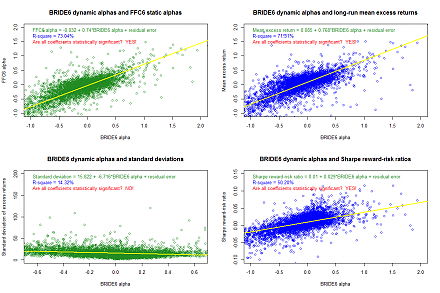

With U.S. fintech patent approval, accreditation, and protection for 20 years, our proprietary alpha investment model outperforms most stock market indexes

2017-02-13 09:35:00 Monday ET

JPMorgan Chase CEO Jamie Dimon says President Trump has now awaken the *animal spirits* in the U.S. stock market. The key phrase, animal spirits, is the

2025-05-29 08:25:28 Thursday ET

Serial venture capitalist Ben Horowitz describes many hard truths, lessons, and insights from his entrepreneurial journey of running LoudCloud from a Silico

2018-05-23 09:41:00 Wednesday ET

Many U.S. large public corporations spend their tax cuts on new dividend payout and share buyback but not on new job creation and R&D innovation. These

2023-01-11 09:26:00 Wednesday ET

Addendum on USPTO fintech patent protection and accreditation As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S