Aqua America, Inc., through its subsidiaries, operates regulated utilities that provide water or wastewater services in the United States. It offers water services through operating and maintenance contracts with municipal authorities and other parties. The company also provides non-utility raw water supply services for firms in the natural gas drilling industry; and water and sewer line protection solutions, and repair services to households through third-party. It serves approximately three million residential water, commercial water, fire protection, industrial water, wastewater, and other water and utility customers in Pennsylvania, Ohio, Texas, Illinois, North Carolina, New Jersey, Indiana, and Virginia. The company was formerly known as Philadelphia Suburban Corporation and changed its name to Aqua America, Inc. in 2004. Aqua America, Inc. was founded in 1886 and is based in Bryn Mawr, Pennsylvania....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2020-01-15 08:31:00 Wednesday ET

Anti-competitive corporate practices may stifle U.S. innovation. In recent decades, wage growth, economic output, and productivity tend to stagnate as U.S.

2018-01-21 07:25:00 Sunday ET

As he refrains from using the memorable phrase *irrational exuberance* to assess bullish investor sentiments, former Fed chairman Alan Greenspan discerns as

2023-05-14 12:31:00 Sunday ET

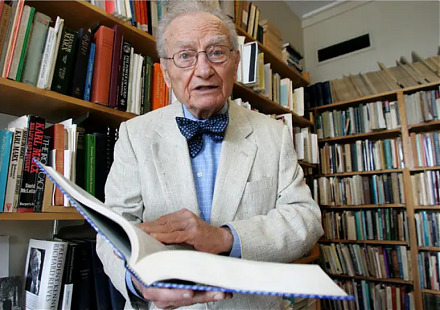

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m

2019-04-27 16:41:00 Saturday ET

Tony Robbins suggests that one has to be able to make money during sleep hours in order to reach financial freedom. Most of our jobs and life experiences tr

2018-11-05 10:40:00 Monday ET

Former Fed Chair Janet Yellen worries about U.S. government debt accumulation, expects new interest rate increases, and warns of the next economic recession

2023-12-05 09:25:00 Tuesday ET

Better corporate ownership governance through worldwide convergence toward Berle-Means stock ownership dispersion Abstract We design a model