United Bankshares, Inc. is a bank holding company whose business is the operation of its bank subsidiaries. All of United's subsidiary banks are full-service commercial banks. Included among the banking services offered are the acceptance of deposits in checking, savings, time and money market accounts; the making and servicing of personal, commercial, floor plan and student loans; and the making of construction and real estate loans. Also offered are individual retirement accounts, safe deposit boxes, wire transfers and other standard banking products and services....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 1 November 2025

2019-10-31 13:38:00 Thursday ET

AYA Analytica finbuzz podcast channel on YouTube October 2019 In this podcast, we discuss several topical issues as of October 2019: (1)

2022-10-05 08:24:00 Wednesday ET

Precautionary-motive and agency reasons for corporate cash management Bates, Kahle, and Stulz (JF 2009) empirically find that public firms have doubled t

2021-05-20 10:30:00 Thursday ET

Artificial intelligence, 5G, and virtual reality can help transform global trade, finance, and technology. Core trade technological advances and disruptive

2019-02-07 07:25:00 Thursday ET

President Trump picks David Malpass to run the World Bank to curb international multilateralism. The Trump administration seems to prefer bilateral negotiat

2018-01-04 07:36:00 Thursday ET

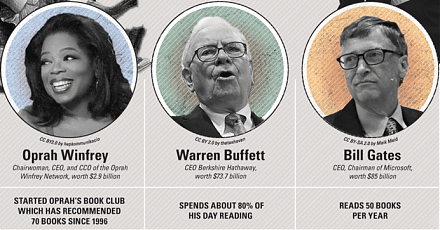

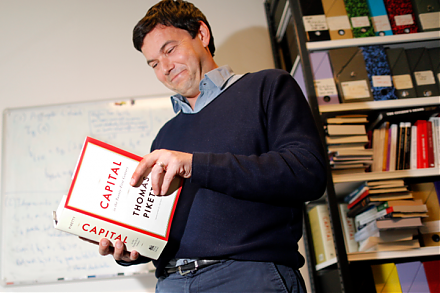

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal

2020-02-19 14:35:00 Wednesday ET

The U.S. bank oligarchy has become bigger, more profitable, and more resistant to public regulation after the global financial crisis. Simon Johnson and