Take Two Interactive Software is a leading developer and publisher of video games. Take Two's games can be played on video consoles, personal computers, mobile devices and tablets. The company earns revenues from the sale of disk-based video game products, downloadable contents, subscription, micro-transactions and advertising. The company develops and publishes games through Rockstar Games, 2K, Private Division, Social Point and Playdots. Take Two's Private Division is the publisher of Kerbal Space Program. Take Two has development studios in Australia, Canada, China, Czech Republic, Hungary, India, Spain, the United Kingdom and the United States. The company sells games both physically and digitally through direct relationships with large retail customers and third-party distributors. GameStop, Microsoft, Sony, Steam and Wal-Mart are the top customers....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-03-09 12:43:00 Saturday ET

Pinterest files a $12 billion IPO due in mid-2019. This tech unicorn allows users to pin-and-browse images through its social media app and website. Pintere

2019-07-21 09:37:00 Sunday ET

Facebook introduces a new cryptocurrency Libra as a fresh medium of exchange for e-commerce. Libra will be available to all the 2 billion active users on Fa

2020-10-13 08:27:00 Tuesday ET

Agile lean enterprises strive to design radical business models to remain competitive in the face of nimble startups and megatrends. Carsten Linz, Gunter

2018-03-19 10:37:00 Monday ET

Uber's autonomous car causes the first known pedestrian fatality from a driverless vehicle and thus sets off the alarm bell for artificial intelligence.

2019-09-17 08:33:00 Tuesday ET

Global stock market investors foresee the harbinger of a major economic downturn. Many stock market investors become anxious due to negative term spreads an

2018-08-13 12:39:00 Monday ET

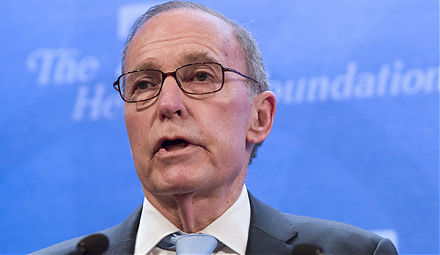

White House chief economic adviser Larry Kudlow points out that the recent U.S. dollar strength shows a clear sign of investor confidence and optimism. Gree