SLM Corporation was formed in 1972. SLM Corporation, commonly known as Sallie Mae, is a holding company that operates through a number of subsidiaries. The Company was formed as the Student Loan Marketing Association, a federally chartered government-sponsored enterprise, with the goal of furthering access to higher education by providing a secondary market for student loans. The Company's main business is to originate, service and collect loans made to students and/or their parents to finance the cost of their education. It provides funding, delivery and servicing support for education loans in the United States through its participation in the Federal Family Education Loan Program, as a servicer of loans for the Department of Education and through its non-federally guaranteed Private Education Loan programs. It provides credit products and related services to the higher education and consumer credit communities and others through two main business segments: Lending business segment and Asset Performance Group business segment. In addition, within its Corporate and Other business segment, it provides a number of products and services that are managed within smaller operating segments, the most prominent being its Guarantor Servicing and Loan Servicing businesses. In the Lending business segment, it originates and acquires both federally guaranteed student loans and Private Education Loans, which are not federally guaranteed. The Company manages the portfolio of FFELP and Private Education Loans in the student loan industry. In the Company's APG business segment, it provides student loan default aversion services, defaulted student loan portfolio management services and contingency collections services for student loans and other asset classes. The Company provides default aversion services for five Guarantors, including the nation's USA Funds. The Company's APG business segment manages the defaulted student loan portfolios for six Guarantors under long-term contracts. The Company's APG business segment is also engaged in the collection of defaulted student loans on behalf of various clients, including schools, Guarantors, ED and other federal and state agencies. The Company has faced competition for both federally guaranteed and non-guaranteed student loans from a variety of financial institutions, including banks, thrifts and state-supported secondary markets. The Company is subject to the HEA and, from time to time, to review of its student loan operations by ED and guarantee agencies. As a third-party service provider to financial institutions, the Company is also subject to examination by the Federal Financial Institutions Examination Council....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 1 November 2025

2023-04-28 16:38:00 Friday ET

Peter Schuck analyzes U.S. government failures and structural problems in light of both institutions and incentives. Peter Schuck (2015) Why

2018-08-19 10:34:00 Sunday ET

The World Economic Forum warns that artificial intelligence may destabilize the financial system. Artificial intelligence poses at least a trifecta of major

2024-03-19 03:35:58 Tuesday ET

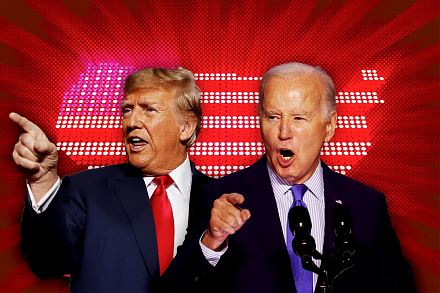

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi

2018-05-10 07:37:00 Thursday ET

Top money managers George Soros and Warren Buffett reveal their current stock and bond positions in their recent corporate disclosures as of mid-2018. Georg

2019-12-07 11:30:00 Saturday ET

China turns on its 5G telecom networks in the hot pursuit of global tech supremacy. China Telecom, China Unicom, and China Mobile disclose 5G fees of $18-$2

2019-07-31 11:34:00 Wednesday ET

AYA Analytica finbuzz podcast channel on YouTube July 2019 In this podcast, we discuss several topical issues as of July 2019: (1) All 18 systemical