Safehold Inc. is a real estate investment trust. It help owners of high quality multifamily, office, industrial, hospitality, student housing, life science and mixed-use properties. Safehold Inc., formerly known as iStar Inc., is based in NEW YORK....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2020-03-12 09:32:00 Thursday ET

Google CEO Eric Schmidt and his co-authors show the innovative corporate culture and mission of the Internet search tech titan. Eric Schmidt, Jonathan Ro

2022-09-25 09:34:00 Sunday ET

Main reasons for share repurchases Temporary market undervaluation often induces corporate incumbents to initiate a share repurchase program to boost the

2019-03-07 12:39:00 Thursday ET

A physicist derives a mathematical formula that success equates the product of both personal quality and the potential value of a random idea. As a Northeas

2019-06-07 04:02:05 Friday ET

The world seeks to reduce medicine prices and other health care costs to better regulate big pharma. Nowadays the Trump administration requires pharmaceutic

2018-09-05 08:34:00 Wednesday ET

Citron Research short-sellers initiate a class-action lawsuit against Tesla and its executive chairman Elon Musk because he might have deliberately orchestr

2018-01-04 07:36:00 Thursday ET

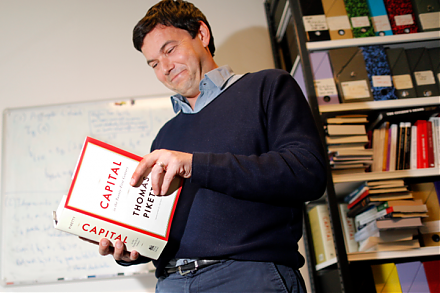

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal