PDC Energy, Inc. is an independent upstream operator engaged in the exploration, development and production of natural gas, crude oil and natural gas liquids. The firm is focused on the Wattenberg Field in Colorado and the Delaware Basin in Texas. PDC Energy's Wattenberg operations are centered around the Niobrara and Codell formations, while the Delaware Basin development primarily targets the Wolfcamp zones. The company is currently the second-largest producer in the Denver-Julesburg Basin behind Occidental Petroleum. The Wattenberg Field is PDC Energy's core operating region. The company is focused on growth through a combination of acquisitions and active drilling....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2017-06-21 05:36:00 Wednesday ET

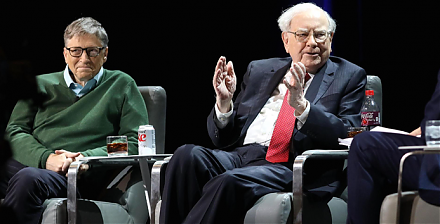

In his latest Berkshire Hathaway annual letter to shareholders, Warren Buffett points out that many people misunderstand his stock investment method in seve

2019-10-27 17:37:00 Sunday ET

International climate change can cause an adverse impact on long-term real GDP economic growth. USC climate change economist Hashem Pesaran and his co-autho

2019-11-06 12:29:00 Wednesday ET

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon (F.A.

2019-05-09 10:28:00 Thursday ET

President Trump ramps up 25% tariffs on $200 billion Chinese imports soon after China backtracks on the Sino-American trade agreement. U.S. trade envoy Robe

2017-11-27 07:39:00 Monday ET

Is it anti-competitive and illegal for passive indexers and mutual funds to place large stock bets in specific industries with high market concentration? Ha

2025-07-05 11:23:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why working with emotional intelligence helps hone our social skills f