J. W. Mays, Inc. operates a number of commercial real estate properties....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-01-03 09:34:00 Tuesday ET

USPTO fintech patent protection and accreditation As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved

2018-12-23 13:39:00 Sunday ET

The House of Representatives considers a government expenditure bill with border wall finance and therefore sets up a shutdown stalemate with Senate. As fre

2022-02-02 10:33:00 Wednesday ET

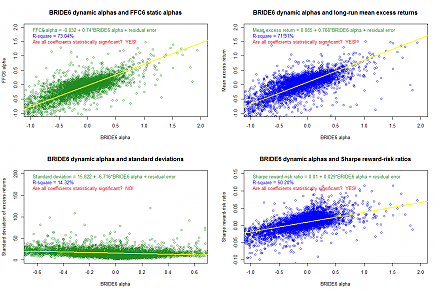

Our proprietary alpha investment model outperforms most stock market indices from 2017 to 2022. As of early-January 2023, the U.S. Patent and Trademark O

2022-02-25 00:00:00 Friday ET

Empirical tests of multi-factor models for asset return prediction The capital asset pricing model (CAPM) of Sharpe (1964), Lintner (1965), and Bla

2019-06-17 11:25:00 Monday ET

To secure better economic arrangements with European Union, Jeremy Corbyn encourages Labour legislators to back a second referendum on Brexit. In recent tim

2018-03-03 11:37:00 Saturday ET

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de