Inter&Co is the holding company of Inter Group and indirectly holds all of Banco Inter's shares. The Company's super app offers financial and non-financial services. It provides range of services in banking, investments, credit, insurance and cross-border services. Inter&Co is based in BELO HORIZONTE, Brazil....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-04-21 10:07:54 Sunday ET

Central bank independence remains important for core inflation containment in the current age of political populism. In accordance with the dual mandate of

2019-09-13 10:37:00 Friday ET

China allows its renminbi currency to slide below the key psychologically important threshold of 7-yuan per U.S. dollar. A currency dispute between the U.S.

2018-08-31 08:42:00 Friday ET

We share several famous inspirational stock market quotes by Warren Buffett, Peter Lynch, Benjamin Graham, Ben Franklin, Philip Fisher, and Michael Jensen.

2018-07-27 10:35:00 Friday ET

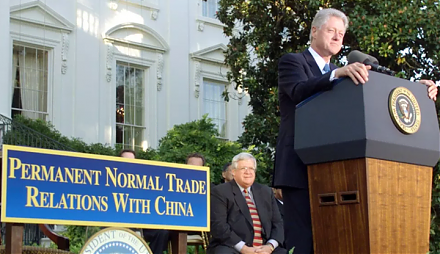

Admitting China to the World Trade Organization (WTO) and other international activities seems ineffective in imparting economic freedom and democracy to th

2019-01-15 13:35:00 Tuesday ET

Americans continue to keep their financial New Year resolutions. First, Americans should save more money. Everyone needs a budget to ensure that key paychec

2018-11-19 09:38:00 Monday ET

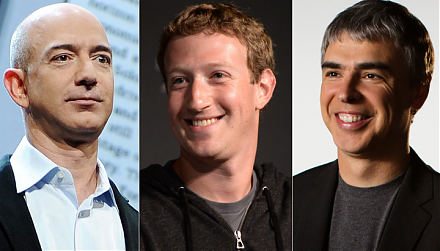

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl