Gladstone Commercial Corporation is a real estate investment trust, or REIT, that was incorporated under the General Corporation Laws of the State of Maryland on February 14, 2003 primarily for the purpose of investing in and owning net leased industrial, commercial and retail real property and selectively making long-term industrial and commercial mortgage loans. The Company's portfolio of real estate is leased to a wide cross section of tenants ranging from small businesses to large public companies, many of which are corporations that do not have publicly rated debt. It has historically entered into, and intends in the future to enter into, purchase agreements for real estate having triple net leases with terms of approximately 10 to 15 years and built in rental rate increases. Under a triple net lease, the tenant is required to pay all operating, maintenance and insurance costs and real estate taxes with respect to the leased property. The Company is actively communicating with buyout funds, real estate brokers and other third parties to locate properties for potential acquisition or to provide mortgage financing in an effort to build its portfolio. It currently owns 73 properties totaling 7.1 million square feet, which have a total gross and net carrying value, including intangible assets, of $513.7 million and $437.2 million, respectively. The Company does not currently have any mortgage loans outstanding. It controls its Operating Partnership through its ownership of GCLP Business Trust II, a Massachusetts business trust, which is the general partner of its Operating Partnership, and of GCLP Business Trust I, a Massachusetts business trust, which currently holds all of the limited partnership units of the Company's Operating Partnership. It expects that its Operating Partnership may issue limited partnership units from time to time in exchange for industrial and commercial real property. The Company 's principal investment objectives are to generate income from rental properties and, to a much lesser extent, mortgage loans, which it uses to fund its continuing operations and to pay out monthly cash distributions to its stockholders. The Company competes with a number of other real estate companies and traditional mortgage lenders, many of whom have greater marketing and financial resources than it does....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 1 November 2025

2018-03-19 10:37:00 Monday ET

Uber's autonomous car causes the first known pedestrian fatality from a driverless vehicle and thus sets off the alarm bell for artificial intelligence.

2018-12-22 14:38:00 Saturday ET

Federal Reserve raises the interest rate to the target range of 2.25% to 2.5% as of December 2018. Fed Chair Jerome Powell highlights the dovish interest ra

2019-07-27 17:37:00 Saturday ET

Capital gravitates toward key profitable mutual funds until the marginal asset return equilibrates near the core stock market benchmark. As Stanford finance

2023-05-14 12:31:00 Sunday ET

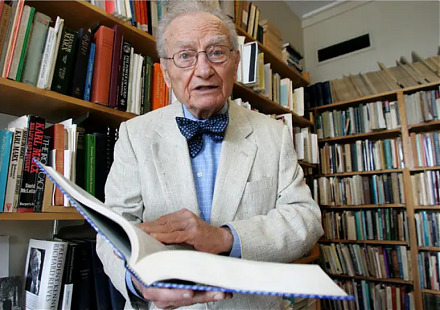

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m

2023-09-07 11:30:00 Thursday ET

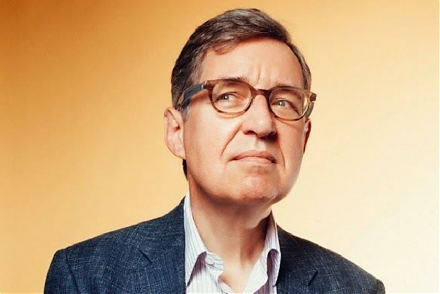

Michael Woodford provides the theoretical foundations of monetary policy rules in ever more efficient financial markets. Michael Woodford (2003)

2023-02-28 11:30:00 Tuesday ET

The Biden Inflation Reduction Act is central to modern world capitalism. As of 2022-2023, global inflation has gradually declined from the peak of 9.8% d