Forum Merger II is a blank check company. It engages in capital stock exchange, asset acquisition, stock purchase, reorganization, share reconstruction, asset management and other financial services. Forum Merger II is based in New York, United States....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-01-27 12:39:00 Sunday ET

British Prime Minister Theresa May faces her landslide defeat in the parliamentary vote 432-to-202 against her Brexit deal. British Parliament rejects the M

2019-03-07 12:39:00 Thursday ET

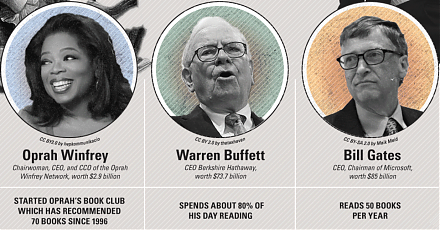

A physicist derives a mathematical formula that success equates the product of both personal quality and the potential value of a random idea. As a Northeas

2018-09-01 07:34:00 Saturday ET

As the French economist who studies global economic inequality in his recent book *Capital in the New Century*, Thomas Piketty co-authors with John Bates Cl

2018-07-15 11:35:00 Sunday ET

Facebook, Google, and Twitter attend a U.S. House testimony on whether these social media titans filter web content for political reasons. These network pla

2018-03-03 11:37:00 Saturday ET

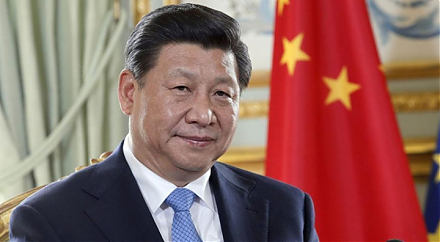

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de

2020-02-02 10:31:00 Sunday ET

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq. We implement