Expand Energy Corporation is an independent natural gas producer principally in the United States. Expand Energy Corporation, formerly known as Chesapeake Energy Corporation, is based in OKLAHOMA CITY....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 28 February 2026

2022-10-25 11:31:00 Tuesday ET

Corporate investment insights from mergers and acquisitions Relative market misvaluation between the bidder and target firms drives most waves of mergers

2025-06-21 10:25:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why emotional intelligence can serve as a more important critical succ

2019-11-19 09:33:00 Tuesday ET

American unemployment declines to the 50-year historical low level of 3.5% with moderate job growth. Despite a sharp slowdown in U.S. services and utilities

2019-03-01 13:36:00 Friday ET

Global economic uncertainty now lurks in a thick layer of mystery. This uncertainty arises from Sino-U.S. trade tension, Brexit fallout, monetary policy nor

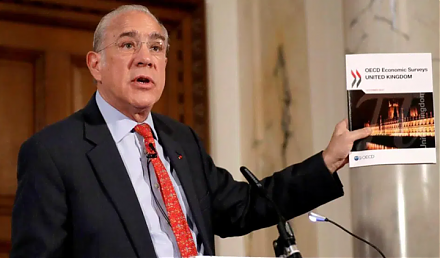

2019-10-29 13:36:00 Tuesday ET

The OECD projects global growth to decline from 3.2% to 2.9% in the current fiscal year 2019-2020. This global economic growth projection represents the slo

2019-05-01 09:27:00 Wednesday ET

Apple settles its 2-year intellectual property lawsuit with Qualcomm by agreeing to a multi-year patent license with royalty payments to the microchip maker