CAVA Group Inc. is a category-defining Mediterranean fast-casual restaurant brand which brings heart, health and humanity to food. CAVA Group Inc. is based in WASHINGTON....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2020-03-05 08:28:00 Thursday ET

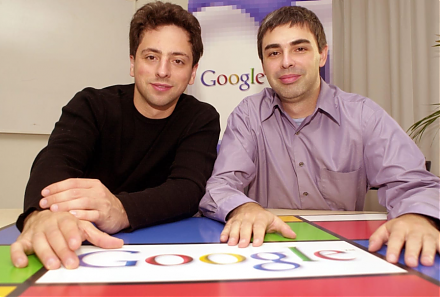

The Stanford computer science overlords Larry Page and Sergey Brin design and develop Google as an Internet search company. Janet Lowe (2009) Google s

2018-01-02 12:39:00 Tuesday ET

Goldman Sachs takes a $5 billion net income hit that results from its offshore cash repatriation under the new Trump tax law. This income hit reflects 10%-1

2023-04-28 16:38:00 Friday ET

Peter Schuck analyzes U.S. government failures and structural problems in light of both institutions and incentives. Peter Schuck (2015) Why

2018-07-17 08:35:00 Tuesday ET

Henry Paulson and Timothy Geithner (former Treasury heads) and Ben Bernanke (former Fed chairman) warn that people seem to have forgotten the lessons of the

2019-08-04 08:26:00 Sunday ET

U.S. and Chinese trade negotiators hold constructive phone talks after Presidents Trump and Xi exchange reconciliatory gestures at the G20 summit in Japan.

2020-09-10 08:31:00 Thursday ET

Most business organizations should continue to create new value in order to achieve long-run success and sustainable profitability. Todd Zenger (2016)