Cascade Acquisition Corp. is a blank check company. It formed for the purpose of merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. The company intend to focus on financial services industry, which includes asset management, consumer and business lending, commercial real estate tech and services, FinTech and business process outsourcing and InsurTech and insurance services, as well as mortgage origination, housing services and technology. Cascade Acquisition Corp. is based in Miami Beach, Florida....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-06-29 17:30:00 Saturday ET

Nobel Laureate Joseph Stiglitz proposes the primary economic priorities in lieu of neoliberalism. Neoliberalism includes lower taxation, deregulation, socia

2017-03-03 05:39:00 Friday ET

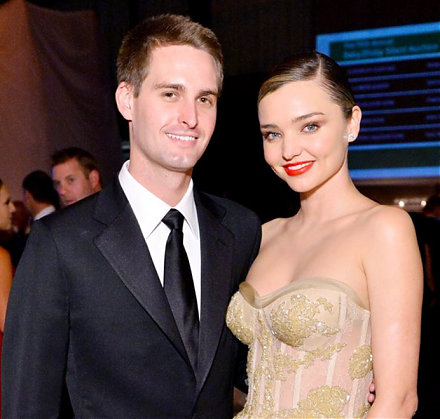

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2017-02-13 09:35:00 Monday ET

JPMorgan Chase CEO Jamie Dimon says President Trump has now awaken the *animal spirits* in the U.S. stock market. The key phrase, animal spirits, is the

2019-07-27 17:37:00 Saturday ET

Capital gravitates toward key profitable mutual funds until the marginal asset return equilibrates near the core stock market benchmark. As Stanford finance

2019-02-06 10:36:49 Wednesday ET

President Trump delivers his second state-of-the-union address to U.S. Congress. Several key themes emerge from this presidential address. First, President

2020-09-11 10:22:00 Friday ET

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools. In recent times, we have completed our fresh website up