Cascade Acquisition Corp. is a blank check company. It formed for the purpose of merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. The company intend to focus on financial services industry, which includes asset management, consumer and business lending, commercial real estate tech and services, FinTech and business process outsourcing and InsurTech and insurance services, as well as mortgage origination, housing services and technology. Cascade Acquisition Corp. is based in Miami Beach, Florida....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-03-27 11:28:00 Wednesday ET

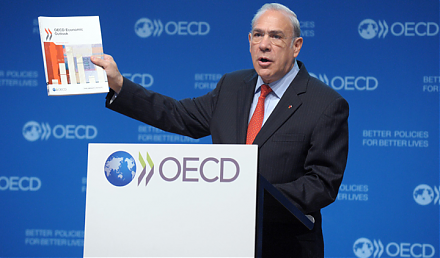

OECD cuts the global economic growth forecast from 3.5% to 3.3% for the current fiscal year 2019-2020. The global economy suffers from economic protraction

2019-09-15 14:35:00 Sunday ET

U.S. Treasury officially designates China a key currency manipulator in the broader context of Sino-American trade dispute resolution. The U.S. Treasury cla

2019-05-05 10:46:10 Sunday ET

This video collection shows the major features of our AYA fintech network platform for stock market investors: (1) AYA stock market content curation;&nbs

2018-12-22 14:38:00 Saturday ET

Federal Reserve raises the interest rate to the target range of 2.25% to 2.5% as of December 2018. Fed Chair Jerome Powell highlights the dovish interest ra

2018-06-25 12:43:00 Monday ET

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung

2018-09-05 08:34:00 Wednesday ET

Citron Research short-sellers initiate a class-action lawsuit against Tesla and its executive chairman Elon Musk because he might have deliberately orchestr