Avis Budget Group operates as a leading vehicle rental operator and a leading global provider of mobility solutions through its three most recognized brands: Avis, Budget and Zipcar. It maintains a leading share of airport car rental revenue in N. America, Europe & Australasia and operates one of the leading truck rental businesses in the U.S. It mainly generates revenues from vehicle rental operations that include time & mileage fees charged to customers for vehicle rentals, sales of loss damage waivers and insurance and other supplemental items in conjunction with vehicle rentals, and payments from customers with respect to certain operating expenses incurred. It earns revenues for royalties and associated fees from its licensees in conjunction with their vehicle rental transactions. It has two segments: Americas, operating in the U.S. and International, operating globally. These segments provide vehicle rental operations, car sharing operations, and licensees....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-07-27 17:37:00 Saturday ET

Capital gravitates toward key profitable mutual funds until the marginal asset return equilibrates near the core stock market benchmark. As Stanford finance

2018-11-09 11:35:00 Friday ET

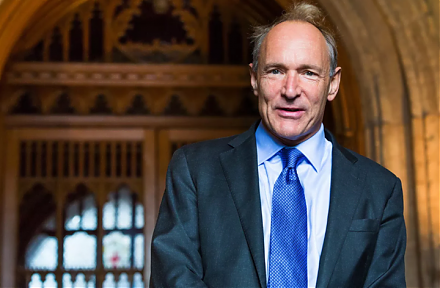

The Internet inventor Tim Berners-Lee suggests that several tech titans might need to be split up in response to some recent data breach and privacy concern

2020-07-12 08:30:00 Sunday ET

The lean CEO encourages iterative continuous improvements and collaborative teams to innovate around core value streams. Jacob Stoller (2015)

2019-07-31 11:34:00 Wednesday ET

AYA Analytica finbuzz podcast channel on YouTube July 2019 In this podcast, we discuss several topical issues as of July 2019: (1) All 18 systemical

2017-12-03 08:37:00 Sunday ET

Sean Parker, Napster founder and a former investor in Facebook, has become a "conscientious objector" on Facebook. Parker says Facebook explo

2018-10-25 10:36:00 Thursday ET

Trump tariffs begin to bite U.S. corporate profits from Ford and Harley-Davidson to Caterpillar and Walmart etc. U.S. corporate profit growth remains high a