Boot Barn Holdings, Inc. operates as a lifestyle retail chain devoted to western and work-related footwear, apparel and accessories. The company's products include boots, denim, western shirts, cowboy hats, belts and belt buckles, and western-style jewellery and accessories; and rugged footwear, outerwear, overalls, denims, and shirts, as well as safety-toe boots, and flame-resistant and high-visibility clothing. It sells its products through bootbarn.com, an e-commerce Website. Boot Barn Holdings, Inc. is headquartered in Irvine, California....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 21 February 2026

2018-07-27 10:35:00 Friday ET

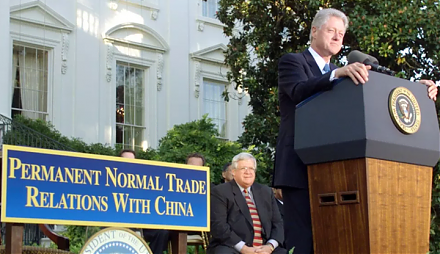

Admitting China to the World Trade Organization (WTO) and other international activities seems ineffective in imparting economic freedom and democracy to th

2019-07-15 16:37:00 Monday ET

President of US-China Business Council Craig Allen states that a trade deal should be within reach if Trump and Xi show courage at G20. A landmark trade agr

2023-10-28 12:29:00 Saturday ET

Paul Morland suggests that demographic changes lead to modern economic growth in the current world. Paul Morland (2019) The human tide: how

2018-03-03 11:37:00 Saturday ET

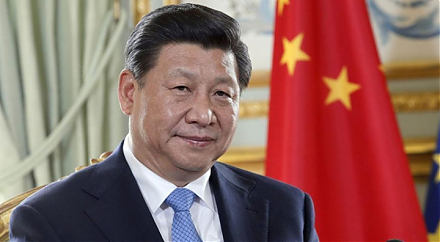

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de

2019-12-22 08:30:00 Sunday ET

European Commission President Ursula von der Leyen now protects the European circular economy and green growth from 2020 to 2050. The new circular economy r

2017-04-01 06:40:00 Saturday ET

With the current interest rate hike, large banks and insurance companies are likely to benefit from higher equity risk premiums and interest rate spreads.