Banzai International Inc. is a marketing technology company which provides essential marketing and sales solutions for businesses. The company's customers include Square, Hewlett Packard Enterprise, Thermo Fisher Scientific, Thinkific, Doodle and ActiveCampaign. Banzai International Inc., formerly known as 7GC & Co. Holdings Inc., is based in SEATTLE....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-03-11 08:27:00 Sunday ET

At 89 years old, Hong Kong billionaire Li Ka-Shing announces his retirement in March 2018. With a personal net worth of $35 billion, Li has an incredible ra

2018-06-17 10:35:00 Sunday ET

In the past decades, capital market liberalization and globalization have combined to connect global financial markets to allow an ocean of money to flow th

2019-07-03 11:35:00 Wednesday ET

U.S. regulatory agencies may consider broader economic issues in their antitrust probe into tech titans such as Amazon, Apple, Facebook, and Google etc. Hou

2023-09-07 11:30:00 Thursday ET

Michael Woodford provides the theoretical foundations of monetary policy rules in ever more efficient financial markets. Michael Woodford (2003)

2023-06-19 10:31:00 Monday ET

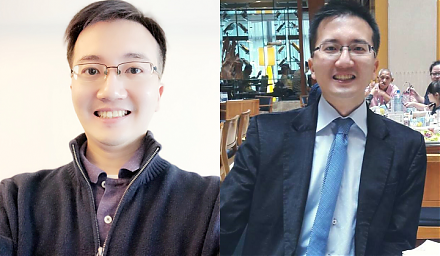

A brief biography of Dr Andy Yeh (PhD, MFE, MMS, BMS, FRM, and USPTO patent accreditation) Dr Andy Yeh is responsible for ensuring maximum sustainable me

2018-03-19 10:37:00 Monday ET

Uber's autonomous car causes the first known pedestrian fatality from a driverless vehicle and thus sets off the alarm bell for artificial intelligence.