Bank of Montreal (the Bank) is a financial services provider. The Bank provides a range of personal and commercial banking, wealth management and investment banking products and services. The Bank conducts its business through three operating groups: Personal and Commercial Banking (P&C), Wealth Management and BMO Capital Markets. The P&C business includes two retail and business banking operating segments, such as Canadian Personal and Commercial Banking (Canadian P&C), and the United States Personal and Commercial Banking (U.S. P&C). The Bank's Wealth Management business serves a range of client segments, from mainstream to ultra-high net worth and institutional, with an offering of wealth management products and services, including insurance. BMO Capital Markets is a North American-based financial services provider offering a range of products and services to corporate, institutional and government clients. The Bank has over 1,500 bank branches in Canada and the United States....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-03-27 11:28:00 Wednesday ET

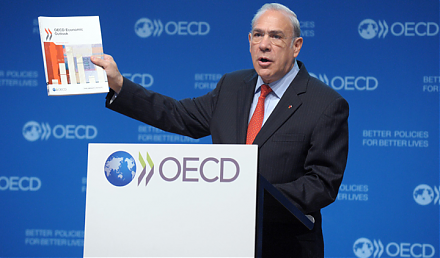

OECD cuts the global economic growth forecast from 3.5% to 3.3% for the current fiscal year 2019-2020. The global economy suffers from economic protraction

2019-06-09 11:29:00 Sunday ET

St Louis Federal Reserve President James Bullard indicates that his ideal baseline scenario remains a mutually beneficial China-U.S. trade deal. Bullard ind

2017-11-23 10:42:00 Thursday ET

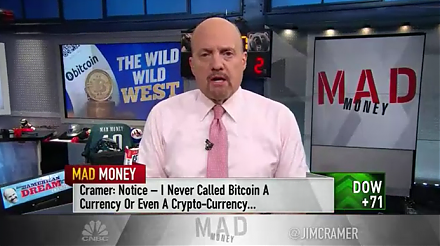

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano

2019-07-13 07:17:00 Saturday ET

Japanese prime minister Shinzo Abe outlines the main economic priorities for the G20 summit in Osaka, Japan. First, Asian countries need to forge the key Re

2025-06-13 08:23:00 Friday ET

What are the mainstream legal origins of President Trump’s new tariff policies? We delve into the mainstream legal origins of President Trump&rsquo

2019-07-29 11:33:00 Monday ET

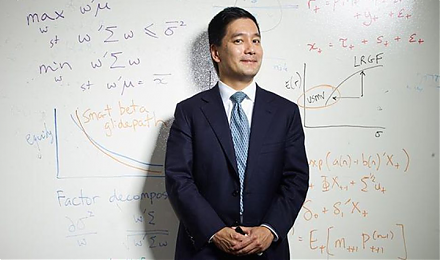

Blackrock asset research director Andrew Ang shares his economic insights into fundamental factors for global asset management. As Ang indicates in an inter