Ball Corporation is a provider of metal packaging for beverages, foods & household products, and of aerospace and other technologies and services to commercial and governmental customers. Ball Corporation stock is traded on the New York Stock Exchange under the ticker symbol BLL. A few years ago, Ball introduced ReAl - a revolutionary technology utilizing recycled aluminum to create a metal alloy that exhibits increased strength and allows weight reduction of the container without affecting package integrity. The original ReAl, which replaced the standard aluminum aerosol can, included 25 percent recycled material to yield an 11 percent lighter package....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 12 July 2025

2023-09-28 08:26:00 Thursday ET

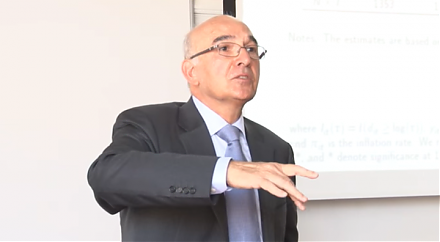

Daron Acemoglu and James Robinson show a constant economic tussle between society and the state in the hot pursuit of liberty. Daron Acemoglu and James R

2020-02-26 09:30:00 Wednesday ET

Goldman Sachs follows the timeless business principles and best practices in financial market design and investment management. William Cohan (2011) M

2019-10-27 17:37:00 Sunday ET

International climate change can cause an adverse impact on long-term real GDP economic growth. USC climate change economist Hashem Pesaran and his co-autho

2023-06-28 09:29:00 Wednesday ET

Carmen Reinhart and Kenneth Rogoff delve into several centuries of cross-country crisis data to find the key root causes of financial crises for asset marke

2018-08-27 09:35:00 Monday ET

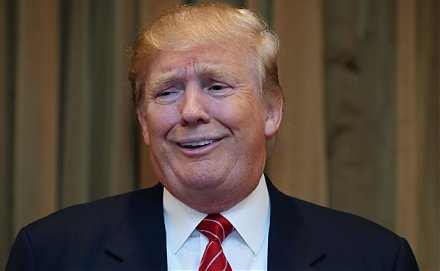

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2019-02-04 07:42:00 Monday ET

Federal Reserve remains patient on future interest rate adjustments due to global headwinds and impasses over American trade and fiscal budget negotiations.