Blueknight Energy Partners, L.P., based in Tulsa, Oklahoma, owns and operates a diversified portfolio of complementary midstream energy assets. It provides midstream services to its customers by focusing in three operational areas: crude oil terminalling and storage, crude oil gathering and transportation services and asphalt terminalling, storage and processing services. The Company's strategically located storage facilities, terminals and pipelines provide customers the flexibility to access multiple receipt and delivery points. Its vision is to use its strategically located assets to be a leading provider of midstream services in the energy industry. It intends to accomplish its objective by: pursuing both strategic and accretive acquisitions within the midstream energy industry, pursuing organic expansion opportunities by constructing additional assets in strategic locations, and expanding storage capacity, particularly at its Cushing terminal, and increasing the profitability of its existing assets....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-09-23 12:25:00 Monday ET

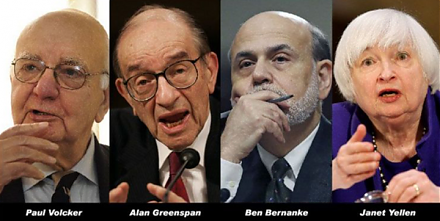

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2020-11-10 07:25:00 Tuesday ET

The McKinsey edge reflects the collective wisdom of key success principles in business management consultancy. Shu Hattori (2015) The McKins

2025-09-18 08:03:32 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-03-29 14:28:00 Thursday ET

Share prices tumble for technology stocks due to Trump's criticism of Amazon's tax avoidance, Facebook user data breach of trust, and Tesla autopilo

2017-11-07 09:38:00 Tuesday ET

HPE CEO Meg Whitman has run both eBay and Hewlett Packard within Fortune 500 and now has decided to step down after her 6-year stint at the technology giant

2019-09-13 10:37:00 Friday ET

China allows its renminbi currency to slide below the key psychologically important threshold of 7-yuan per U.S. dollar. A currency dispute between the U.S.