Brighthouse Financial, Inc. is a holding company formed to own the legal entities that historically operated a substantial portion of the former Retail segment of MetLife, Inc. Brighthouse Financial is one of the largest providers of annuity and life insurance products in the United States through multiple independent distribution channels and marketing arrangements with a diverse network of distribution partners. The company reports through three segments: Annuities, Life and Run-off. In addition, the company reports certain of its results of operations in Corporate & Other....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-05-02 13:30:00 Thursday ET

Netflix has an unsustainable business model in the meantime. Netflix maintains a small premium membership fee of $9-$14 per month for its unique collection

2018-04-23 07:43:00 Monday ET

Harvard professor and former IMF chief economist Kenneth Rogoff advocates that artificial intelligence helps augment human productivity growth in the next d

2019-05-01 09:27:00 Wednesday ET

Apple settles its 2-year intellectual property lawsuit with Qualcomm by agreeing to a multi-year patent license with royalty payments to the microchip maker

2019-05-05 10:46:10 Sunday ET

This video collection shows the major features of our AYA fintech network platform for stock market investors: (1) AYA stock market content curation;&nbs

2025-09-16 09:27:00 Tuesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2017-08-01 09:40:00 Tuesday ET

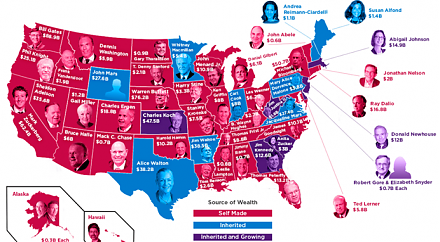

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N