The Brink's Company is the global leader in total cash management, secure route-based logistics and payment solutions including cash-in-transit, ATM services, cash management services (including vault outsourcing, money processing and intelligent safe services), and international transportation of valuables. Their customers include financial institutions, retailers, government agencies, mints, jewelers and other commercial operations. Their global network of operations in 41 countries serves customers in more than 100 countries....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-01-15 07:35:00 Monday ET

Treasury Secretary Steven Mnuchin welcomes a weak U.S. dollar amid pervasive fears of an open trade war between America and China. At the World Economic For

2025-01-22 08:35:08 Wednesday ET

President Donald Trump blames China for the long prevalent U.S. trade deficits and several other social and economic deficiencies. In recent years, Pres

2023-06-19 10:31:00 Monday ET

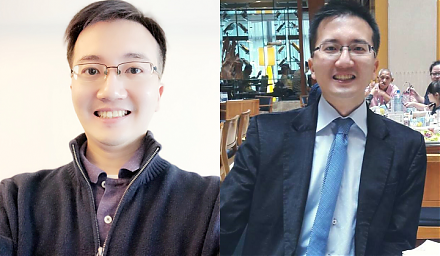

A brief biography of Dr Andy Yeh (PhD, MFE, MMS, BMS, FRM, and USPTO patent accreditation) Dr Andy Yeh is responsible for ensuring maximum sustainable me

2019-03-05 10:40:00 Tuesday ET

We may need to reconsider the new rules of personal finance. First, renting a home can be a smart money move, whereas, buying a home cannot always be a good

2019-08-28 14:46:00 Wednesday ET

Santa-Barbara political economy professor Benjamin Cohen proposes new fiscal stimulus to complement the current low-interest-rate monetary policy. Cohen fin

2020-05-21 11:30:00 Thursday ET

Most blue-ocean strategists shift fundamental focus from current competitors to alternative non-customers with new market space. W. Chan Kim and Renee Ma