Alteryx, Inc. provides self-service data analytics software platform. The Company's product consists of Alteryx Designer, Alteryx Server and Alteryx Analytics Gallery. Alteryx Designer offer data preparation, blending and analytics which could be deployable in the cloud and on premise; Alteryx Server, a secure and scalable product for sharing and running analytic applications in a Web-based environment and Alteryx Analytics Gallery, a cloud-based collaboration offering which allows users to share workflows in a centralized repository. Alteryx, Inc. is headquartered in Irvine, California....

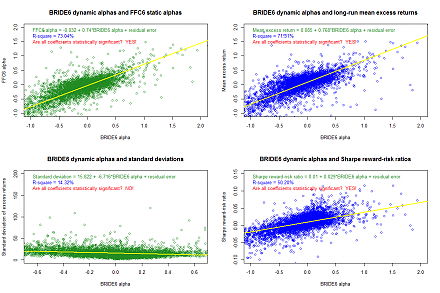

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2017-05-25 08:35:00 Thursday ET

Treasury Secretary Steve Mnuchin has released a 147-page report on financial deregulation under the Trump administration. This financial deregulation seeks

2018-02-03 07:42:00 Saturday ET

Quant Quake 2.0 shakes investor confidence with rampant stock market fears and doubts during the recent Fed Chair transition from Janet Yellen to Jerome Pow

2018-01-13 08:39:00 Saturday ET

The Economist digs deep into the political economy of U.S. government shutdown over 3 days in January 2018. In more than 4 years since 2014, U.S. government

2018-06-04 08:38:00 Monday ET

Microsoft acquires GitHub, a software development platform that has been widely shared-and-used by more than 28 million programmers worldwide. GitHub's

2023-07-28 11:28:00 Friday ET

Lucian Bebchuk and Jesse Fried critique that executive pay often cannot help explain the stock return and operational performance of most U.S. public corpor

2023-01-11 09:26:00 Wednesday ET

Addendum on USPTO fintech patent protection and accreditation As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S