Aware, Inc. is a provider of biometrics software products and development services. The company's product includes SDKs, software components, workstation applications and a modular, centralized, service-oriented platform. It serves government departments, system integrators and solution suppliers. Aware, Inc. is based in Bedford, Massachusetts....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-04-25 09:35:00 Thursday ET

Bridgewater hedge fund founder Ray Dalio suggests that the current state of U.S. capitalism poses an existential threat for many Americans. Dalio deems the

2023-02-21 08:27:00 Tuesday ET

Mark Granovetter follows the key principles of modern economic sociology to analyze social relations and economic phenomena. Mark Granovetter (2017) &

2018-01-21 07:25:00 Sunday ET

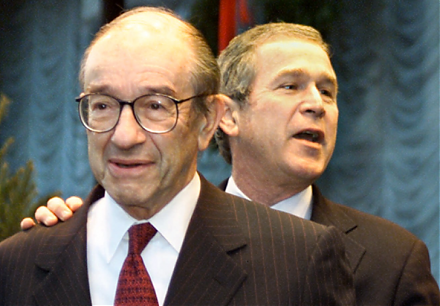

As he refrains from using the memorable phrase *irrational exuberance* to assess bullish investor sentiments, former Fed chairman Alan Greenspan discerns as

2018-07-07 10:33:00 Saturday ET

The east-west tech rivalry intensifies between BATs (Baidu, Alibaba, and Tencent) and FAANGs (Facebook, Apple, Amazon, Netflix, and Google). These Sino-U.S.

2018-09-05 08:34:00 Wednesday ET

Citron Research short-sellers initiate a class-action lawsuit against Tesla and its executive chairman Elon Musk because he might have deliberately orchestr

2019-03-03 10:39:00 Sunday ET

Tech companies seek to serve as quasi-financial intermediaries. Retail traders can list items for sale on eBay and then acquire these items economically on