Atento S.A. is a provider of customer relationship management and business process outsourcing (`CRM BPO`) services in Latin America and Spain. Its CRM BPO services include customer service, sales, credit management, technical support, back office, and service desk, as well as other BPO process services, such as training activities, workstation infrastructure, interactive voice response port implementation, telecommunications infrastructure, application development, and others. The Company's clients are mostly multinational corporations in sectors such as telecommunications, banking and finance, health, consumption and public administration, among others. Atento S.A. is based in Luxembourg....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2024-04-30 09:30:00 Tuesday ET

With clean and green energy resources and electric vehicles, the global auto industry now navigates at a newer and faster pace. Both BYD and Tesla have

2020-11-22 11:30:00 Sunday ET

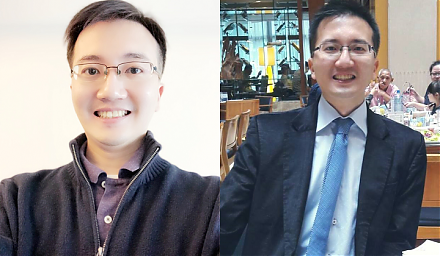

A brief biography of Andy Yeh Andy Yeh is responsible for ensuring maximum sustainable member growth within the Andy Yeh Alpha (AYA) fintech network pla

2023-04-07 12:29:00 Friday ET

Timothy Geithner shares his reflections on the post-crisis macro financial stress tests for U.S. banks. Timothy Geithner (2014) Macrofinanci

2023-05-21 12:26:00 Sunday ET

Amy Chua and Jed Rubenfeld suggest that relatively successful ethnic groups exhibit common cultural traits in America. Amy Chua and Jed Rubenfeld (2015)

2025-10-05 17:31:00 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2025-09-16 09:27:00 Tuesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund