Actinium Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company developing ARCs or Antibody Radiation-Conjugates, which combine the targeting ability of antibodies with the cell killing ability of radiation. Actinium's lead application for their ARCs is targeted conditioning, which is intended to selectively deplete a patient's disease or cancer cells and certain immune cells prior to a BMT or Bone Marrow Transplant, Gene Therapy or Adoptive Cell Therapy (ACT) such as CAR-T to enable engraftment of these transplanted cells with minimal toxicities. With their ARC approach, they seek to improve patient outcomes and access to these potentially curative treatments by eliminating or reducing the non-targeted chemotherapy that is used for conditioning in standard practice currently. Their lead product candidate, I-131 apamistamab (Iomab-B) is being studied in the ongoing pivotal Phase 3 Study of Iomab-B in Elderly Relapsed or Refractory Acute Myeloid Leukemia (SIERRA) trial for BMT conditioning. The SI...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-12-07 11:35:00 Friday ET

Fed Chair Jerome Powell hints slower interest rate increases because the current rate is just below the neutral threshold. NYSE and NASDAQ share prices rebo

2017-11-17 09:42:00 Friday ET

The Trump administration garners congressional support from both Senate and the House of Representatives to pass the $1.5 trillion tax overhaul (Tax Cuts &a

2018-08-15 14:40:00 Wednesday ET

Senator Elizabeth Warren advocates the alternative view that most U.S. trade deals serve corporate interests over workers, customers, and suppliers etc. She

2023-12-07 07:22:00 Thursday ET

Economic policy incrementalism for better fiscal and monetary policy coordination Traditionally, fiscal and monetary policies were made incrementally. In

2019-01-10 17:31:00 Thursday ET

The recent Bristol-Myers Squibb acquisition of American Celgene is the $90 billion biggest biotech deal in history. The resultant biopharma goliath would be

2023-09-07 11:30:00 Thursday ET

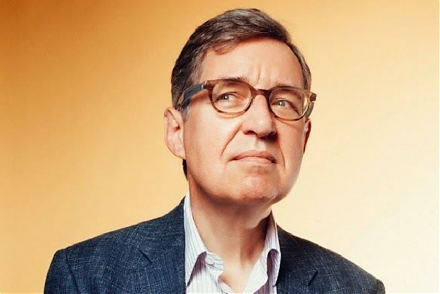

Michael Woodford provides the theoretical foundations of monetary policy rules in ever more efficient financial markets. Michael Woodford (2003)