Attis Industries, Inc., a technology company, focuses on biomass innovation and healthcare technologies. The company operates in two divisions, Technologies and Innovation. The Technology division focuses on providing patient care services; diagnostic and therapeutic solutions for patients and healthcare providers; and products and services in various areas, including hospital consulting services for laboratory and emergency department, polymerase chain reaction molecular testing, pharmacogenetics testing, and medication therapy management. This division also offers Bright City, a mobile application that enables towns, cities, and municipalities to communicate directly. The Innovation division focuses on producing materials and fuels from renewable sources. The company was formerly known as Meridian Waste Solutions, Inc. and changed its name to Attis Industries, Inc. in April 2018. Attis Industries, Inc. was incorporated in 1993 and is headquartered in Milton, Georgia....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 28 June 2025

2019-06-03 11:31:00 Monday ET

The Sino-U.S. trade war may be the Thucydides trap or a clash of Caucasian and non-Caucasian civilizations. The proverbial Thucydides trap refers to the his

2017-03-03 05:39:00 Friday ET

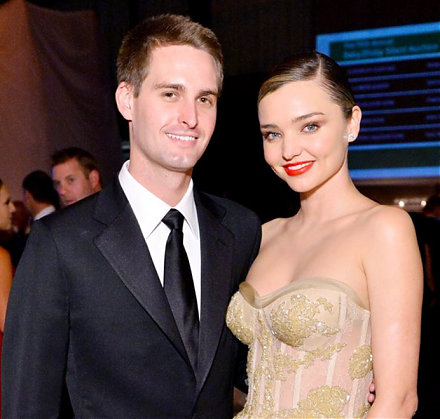

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2019-11-19 09:33:00 Tuesday ET

American unemployment declines to the 50-year historical low level of 3.5% with moderate job growth. Despite a sharp slowdown in U.S. services and utilities

2022-11-30 09:26:00 Wednesday ET

Climate change and ESG woke capitalism In recent times, the Biden administration has signed into law a $375 billion program to better balance the economi

2019-02-05 10:32:00 Tuesday ET

President Trump remains optimistic about the Sino-American trade war resolution of both trade deficit eradication and tech transfer enforcement. Trump now s

2017-06-09 06:37:00 Friday ET

To complement President Trump's pro-business economic policies such as low taxation, new infrastructure, greater job creation, and technological in