Asterias Biotherapeutics, Inc., incorporated on October 24, 2012, is a biotechnology company. The Company is engaged in developing and commercializing therapies in the fields of cell therapy and regenerative medicine. The Company has over two technology platforms. The first is an immunotherapy platform to teach cancer patients' immune systems to attack their tumors. The second is pluripotent stem cell platform. Pluripotent cells are a type of stem cell capable of becoming all of the cell types in the human body. The Company is focused on developing therapies to treat conditions with medical needs and inadequate available therapies, with an initial focus on the therapeutic areas of oncology and neurology. From its immunotherapy platform, the Company is developing over two programs. AST-VAC1 (telomerase loaded, autologous dendritic cells), which allows patient's own cells to recognize and fight cancer cells in acute myelogenous leukemia (AML). Together with its collaboration partner, Cancer Research United Kingdom (CRUK), it is developing AST-VAC2 (telomerase loaded, -allogeneic dendritic cells), -derived from pluripotent stem cells which could provide off the shelf cells that teaches a patient's immune system to recognize and fight cancer cells, in non-small cell lung cancer. From its pluripotent stem cell platform, it is developing AST-OPC1, oligodendrocyte progenitor cells, in an initial clinical indication of spinal cord injury, with potential for later expansion into other neurodegenerative diseases, such as stroke and multiple sclerosis. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-05-28 10:24:00 Sunday ET

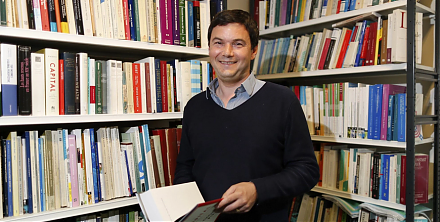

Thomas Piketty connects the dots between economic growth and inequality worldwide with long-term global empirical evidence. Thomas Piketty (2017) &nbs

2020-02-26 09:30:00 Wednesday ET

Goldman Sachs follows the timeless business principles and best practices in financial market design and investment management. William Cohan (2011) M

2017-09-03 10:44:00 Sunday ET

President Donald Trump has released his plan to slash income taxes for U.S. citizens and corporations. The corporate income tax rate will decline from 35% t

2019-11-19 09:33:00 Tuesday ET

American unemployment declines to the 50-year historical low level of 3.5% with moderate job growth. Despite a sharp slowdown in U.S. services and utilities

2019-01-17 10:41:00 Thursday ET

Sino-American trade talks make positive progress over 3 consecutive days as S&P 500 and global stock market indices post 3-day win streaks. Asian and Eu

2019-05-21 12:37:00 Tuesday ET

Chicago finance professor Raghuram Rajan shows that free markets need populist support against an unholy alliance of private-sector and state elites. When a