Asterias Biotherapeutics, Inc., incorporated on October 24, 2012, is a biotechnology company. The Company is engaged in developing and commercializing therapies in the fields of cell therapy and regenerative medicine. The Company has over two technology platforms. The first is an immunotherapy platform to teach cancer patients' immune systems to attack their tumors. The second is pluripotent stem cell platform. Pluripotent cells are a type of stem cell capable of becoming all of the cell types in the human body. The Company is focused on developing therapies to treat conditions with medical needs and inadequate available therapies, with an initial focus on the therapeutic areas of oncology and neurology. From its immunotherapy platform, the Company is developing over two programs. AST-VAC1 (telomerase loaded, autologous dendritic cells), which allows patient's own cells to recognize and fight cancer cells in acute myelogenous leukemia (AML). Together with its collaboration partner, Cancer Research United Kingdom (CRUK), it is developing AST-VAC2 (telomerase loaded, -allogeneic dendritic cells), -derived from pluripotent stem cells which could provide off the shelf cells that teaches a patient's immune system to recognize and fight cancer cells, in non-small cell lung cancer. From its pluripotent stem cell platform, it is developing AST-OPC1, oligodendrocyte progenitor cells, in an initial clinical indication of spinal cord injury, with potential for later expansion into other neurodegenerative diseases, such as stroke and multiple sclerosis. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-06-14 10:26:00 Wednesday ET

Daron Acemoglu and James Robinson show that good inclusive institutions contribute to better long-run economic growth. Daron Acemoglu and James Robinson

2023-12-09 08:28:00 Saturday ET

International trade, immigration, and elite-mass conflict The elite model portrays public policy as a reflection of the interests and values of elites. I

2019-05-02 13:30:00 Thursday ET

Netflix has an unsustainable business model in the meantime. Netflix maintains a small premium membership fee of $9-$14 per month for its unique collection

2019-04-17 11:34:00 Wednesday ET

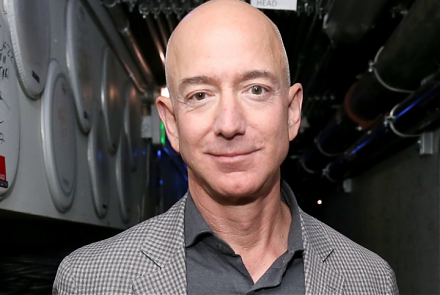

Amazon CEO Jeff Bezos admits the fact that antitrust scrutiny remains a primary imminent threat to his e-commerce business empire. In his annual letter to A

2024-04-30 09:30:00 Tuesday ET

With clean and green energy resources and electric vehicles, the global auto industry now navigates at a newer and faster pace. Both BYD and Tesla have

2019-01-06 08:39:00 Sunday ET

President Trump signs an executive order to freeze federal employee pay in early-2019. Federal employees face furlough or work without pay due to the govern